- The FTX is about to repay the primary collectors from Could 30, which doubtlessly places billions on the crypto market.

- It’s unlikely that SEC will approve the ready ETF earlier than August, which the investor delayed once more.

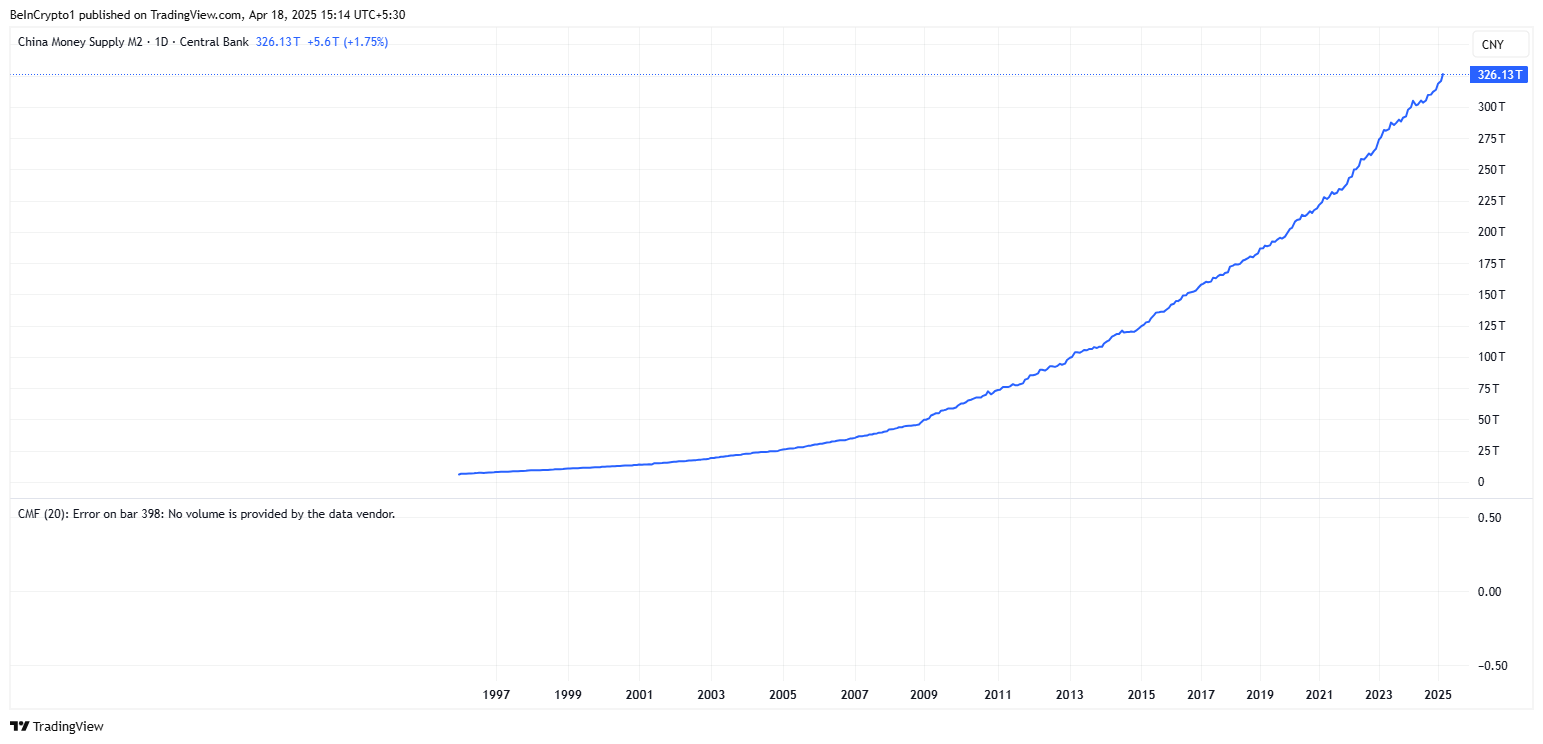

- The Chinese language document enhance in cash provide M2 might mild a contemporary wave of demand for dangerous belongings resembling bitcoins.

The Krypto world stares on Could 30, when the 2 principal occasions on this present day can affect on the markets of digital belongings: the lengthy -awaited FTX creditor and the upcoming resolution -making deadlines for the US regulatory authorities on crypt ETFs.

FTX reimbursement: Liquidity injection or sentiment damping?

Virtually 27 months after its catastrophic collapse in November 2022, FTX is lastly getting ready to repay the collectors, whereas funds of over $ 50,000 are scheduled for 30 Could.

In accordance with chapter consultant Andrew Dietderich, the change – now led by CEO John Ray III – will draw from its money provides of $ 11.4 billion to start out paying funds.

Contemporary billions of billions within the arms of cryptoral traders might trigger the acquisition of dynamics-especially if these funds are reinvested in digital belongings at a time when the sentiment is cautiously bull.

SEC ETF Resolution: Delay continues to be anticipated

Whereas FTX Information provides a motive for optimism, SEC continues to progress in Crypto ETF. The Bloomberg-Following Checklist of purposes reveals greater than 70 ETF submissions throughout totally different belongings together with XRP, Solana, Litecoin and Ethereum. Virtually all of those purposes stay in a limb assessment.

The primary key deadline for a drop in 30 Could – on the identical day FTX funds will start. Nevertheless, analysts are broadly anticipated that SEC is once more delaying approval and shifting the primary resolution most likely till August to extra regulatory readability.

Associated: Highlight on XRP, Solana As 72 Crypto ETFS Search Sec Approval This yr

With Paul Atkins he has now swore as chairman of the 34 SEC, optimism bubbles. The well-known supporter of the effectivity of the capital market, Atkins' return might report within the SEC to the crypto-forward period, which has been postponed from the restrictive perspective of Gary Gensler's management. Nevertheless, this shift might not present its tooth later in the summertime.

Macro Issue: Chinese language document cash provide

In a parallel narration, Macro has climbed the Chinese language cash provide to greater than $ 44.7 trillion, signaling the continued enhance in international liquidity. Traditionally, such enlargement correlates with rally in dangerous belongings resembling crypto.

Associated: Bitcoin dominance reaches a brand new peak of the cycle as a result of altcoins can't sustain

Analyst Kong Buying and selling famous: “Cash printers is again. Danger belongings are getting ready parabolically.” The results are clear: if liquidity is rising and the market capital will re -enter, an ideal storm can cook dinner.

Renunciation of accountability: The knowledge on this article is just for info and academic functions. The article doesn’t signify monetary recommendation or recommendation of any form. Coin Version is just not accountable for any losses as a consequence of using content material, services or products. It’s endorsed that the readers ought to proceed with warning earlier than taking any measures with the corporate.