- Aave Labs proposes integration of BlackRock's BUIDL with GHO's stability module.

- The goal of the replace is to extend capital effectivity and broaden the actual return on belongings.

- BUIDL integration permits 1:1 USDC swaps, month-to-month dividends and seamless transactions.

In an effort to enhance its stablecoin system, Aave Labs launched a brand new temperature management design for the GHO Stability Module (GSM) replace. The objective of this replace is to combine BUIDL, a tokenized fund managed by BlackRock, into the GSM infrastructure.

The proposal seeks to optimize capital effectivity and broaden Aave's sources of income by leveraging conventional monetary belongings by means of blockchain know-how.

Optimizing GHO stability utilizing BUIDL integration

The first objective of Aave Labs' proposal is to enhance the capital effectivity of the GHO Stability Module (GSM) by integrating BlackRock's BUIDL.

At present, GSM ensures the steadiness of Aave's native stablecoin, GHO, by sustaining 1:1 exchangeability with one other asset, usually USD Coin (USDC). Nonetheless, within the present system, extra USDC typically stay idle.

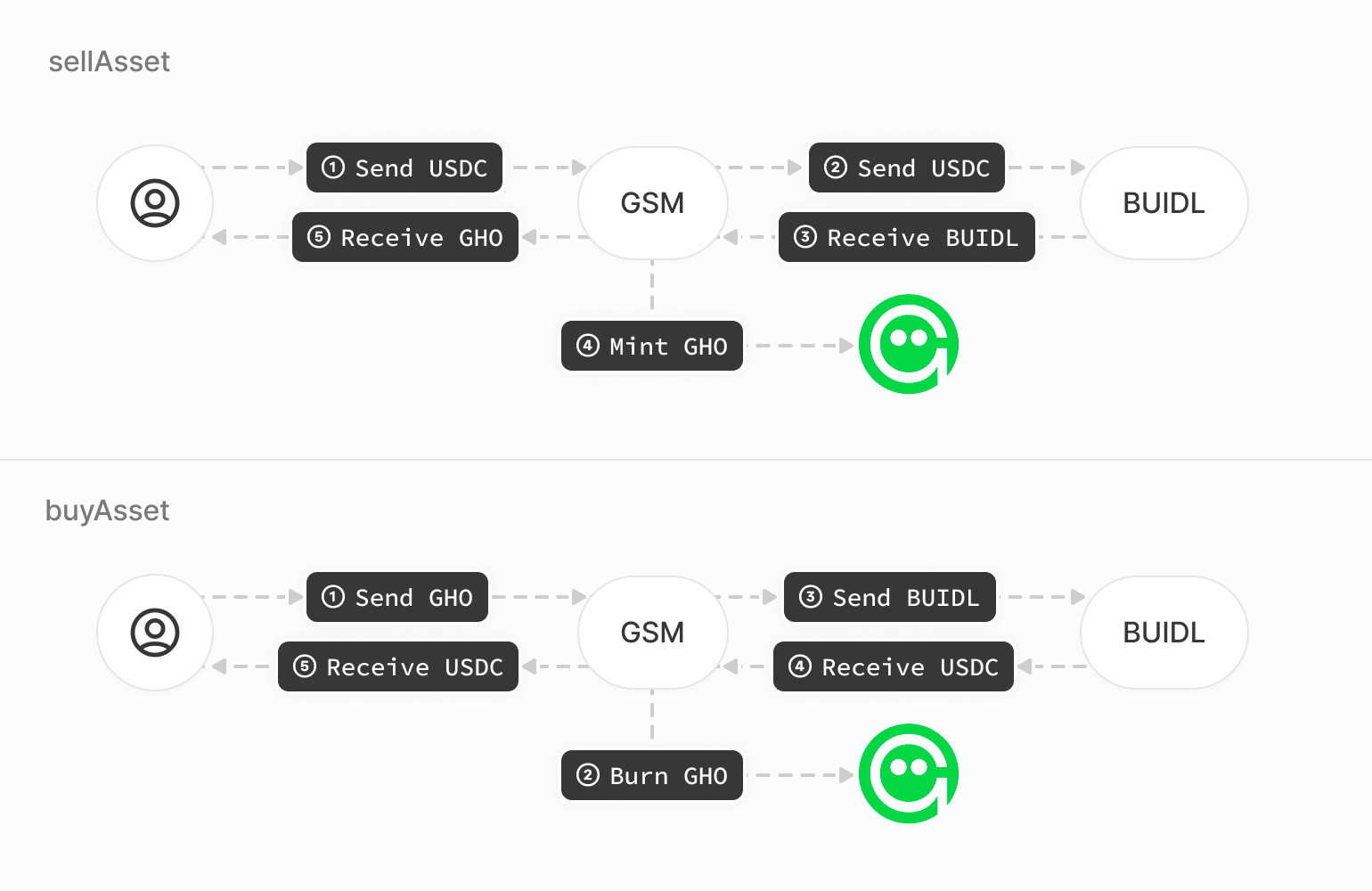

The proposed integration entails constructing a brand new GSM occasion that helps exterior integrations and management mechanisms, particularly designed to include BlackRock's BUIDL, a tokenized fund deployed on the Ethereum community representing conventional monetary belongings reminiscent of money and US Treasury payments.

By utilizing extra USDC to mint BUIDL tokens, the up to date GSM goals to extend its effectivity whereas sustaining the excessive requirements of assist supplied by USDC.

BUIDL affords a number of advantages, together with on-chain entry to conventional monetary belongings managed by BlackRock Monetary Administration Inc., with BNY Mellon as custodian and PricewaterhouseCoopers LLP as fund auditor.

Priced at $1 per token, BUIDL pays out every day amassed dividends to holders within the type of new tokens each month. This construction permits holders to earn returns whereas sustaining flexibility in custody choices and the power to switch tokens 24 hours a day, seven days per week all year long.

Future prospects and technical specs of the combination

Integrating BUIDL into GSM may open up new avenues for Aave DAO, probably increasing income streams into actual belongings (RWA) and strengthening partnership alternatives with BlackRock.

The proposal envisages enabling fastened 1:1 swaps between USDC and GHO, with extra USDC getting used to mint BUIDL tokens. This setup is designed to offer a seamless expertise much like the prevailing GHO:USDC GSM, with swap charges accumulating in GHO and dividends paid out in BUIDL.

The technical specs for this integration embody modifications to the GSM contract code to assist GHO <> USDC transfers and dividend receipt. As well as, BUIDL holders should be registered or approved, which requires additional modifications to the GSM itself.

An in depth specification will likely be supplied throughout the ARFC part, with the design at present in the neighborhood suggestions part.

If consensus is reached, it can transfer to the Snapshot part and, if accredited, to the ARFC part for closing implementation.

The proposal represents a major step in direction of integrating conventional monetary mechanisms with blockchain know-how, probably rising capital effectivity and increasing Aave's strategic partnerships.