The value of Bitcoin has been underneath important bearish stress for the previous few weeks, and this cryptocurrency researcher defined the position of demand available in the market correction.

Obvious BTC Demand Falling – Trigger for Alarm?

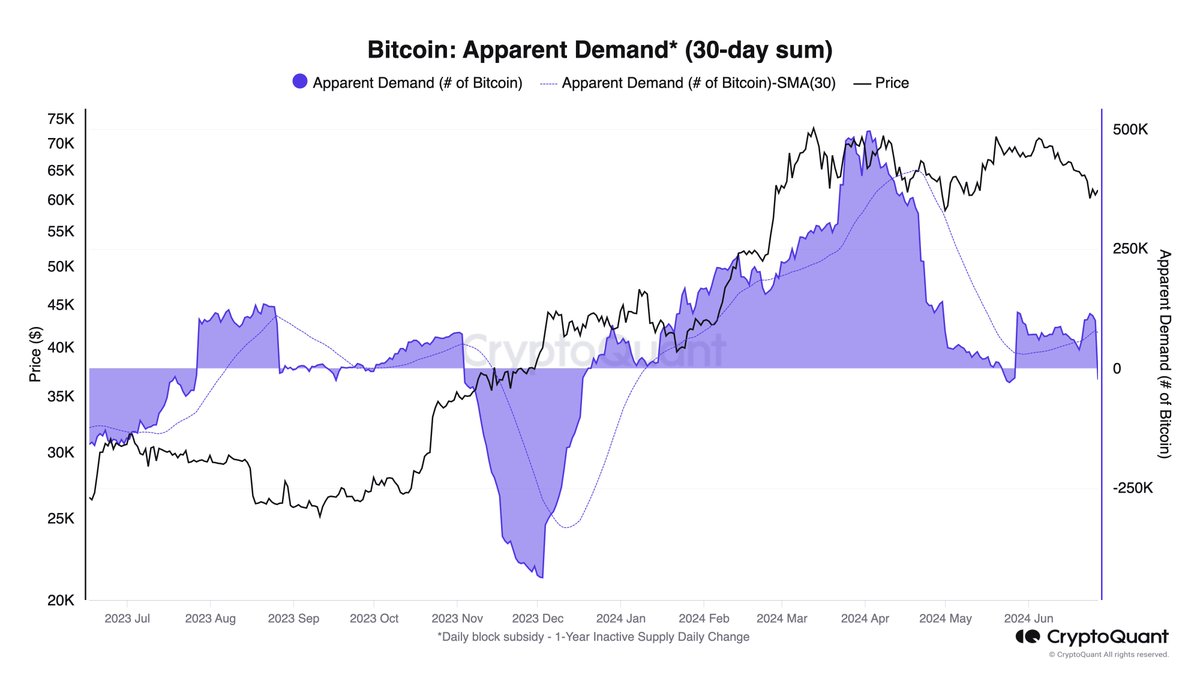

In a current publish on Platform X, CryptoQuant's head of analysis, Julio Moreno, defined how the newest bitcoin value correction is expounded to the falling demand for bitcoins. This evaluation is predicated on the obvious demand metric for Bitcoin on the CryptoQuant platform.

The calculation of obvious demand is usually utilized in monetary markets to evaluate demand by evaluating manufacturing ranges and stock adjustments. Mainly, this metric offers a transparent image of whether or not demand is growing or lowering.

Within the case of cryptocurrencies similar to Bitcoin, obvious demand is calculated utilizing the idea of inactive provide. This idea tracks the quantity of bitcoins that haven’t been moved or transferred over a time period.

As Moreno identified, the chart under makes use of the 1-year inactive provide as a “proxy for stock.” This implies it tracks the quantity of BTC that has not been moved or transacted in over a 12 months.

Chart exhibiting BTC obvious demand and value | Supply: jjcmoreno/X

In accordance with information from CryptoQuant, roughly 23,000 BTC have flown out of the 1-year inactive pool within the final 30 days. This means a drop in demand for Bitcoin as long-term traders appear to have determined to dump and transfer their Bitcoins.

This drop in demand has a number of implications, particularly on the worth of the main cryptocurrency. For instance, CryptoQuant's head of analysis famous that low demand is likely one of the catalysts for the current value correction.

The inflow of great quantities of BTC from long-term holders into the market will increase the accessible provide, thereby placing downward stress on costs. Moreover, value crashes can happen when the market's shopping for stress is just not enough to soak up the extra provide.

CryptoQuant revealed in a weekly report that demand for Bitcoin has dropped considerably in comparison with Q1 – following the launch of US spot exchange-traded funds. With costs presently falling, it seems that a rise in demand for BTC could gas a resumption of the present bull run.

Bitcoin value at a look

On the time of writing, Bitcoin is hovering round $60,790, reflecting a 1.6% decline over the previous week. The market chief has fallen practically 6% over the previous week, in keeping with information from CoinGecko.

The value of BTC thickens across the $60,000 mark on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView