Bitcoin is trying to enter again into the $65,000 value vary amid value volatility within the final 24 hours. The newest numbers from two completely different metrics recommend that this might quickly change into a actuality, and Bitcoin could possibly be effectively on its option to a value rally. As a cryptoanalyst famous on social media, the extent and foundation of Bitcoin's funding factors to a “leg up.”

Bitcoin is within the making

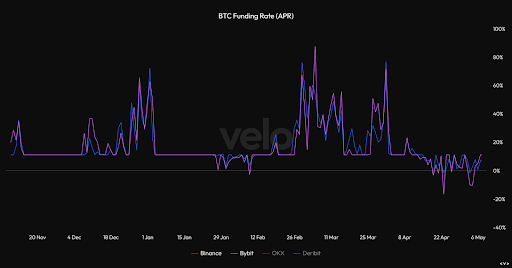

In keeping with a social media put up by Will Clement, a preferred crypto analyst, each the funding charge and the 3-month annual foundation for Bitcoin are beginning to cool after briefly turning detrimental previously few weeks. Which means that lengthy asset trades are beginning to prevail as traders regain confidence in its belongings. potential value motion Iwithin the coming weeks.

Associated Studying: Shiba Inu Whale Strikes 1.7 Trillion SHIB As Value Matches, The place Are They Headed?

I had a superb take a look at the marketplace for the primary time in per week.

Funding charges and the idea have cooled after briefly going detrimental, whereas stablecoin shares are rising once more. Appears like we're consolidating forward of the subsequent stage. pic.twitter.com/OHLkMrTqUY

— Will (@WClementeIII) Could 7, 2024

A detailed take a look at the chart shared by Clement reveals that the funding charge particularly has been within the detrimental for the reason that final week of April, hitting its lowest level on April twenty second. Nonetheless, the present value motion has moved the funding charge again into constructive territory. The BTC funding charge rebounded from a detrimental charge of -0.0050% on Could 4th to a present charge of 0.0090%, primarily based on data from Coinglass. Curiously, this enhance in funding charges translated right into a concurrent enhance within the value of Bitcoin, with the cryptocurrency reaching as excessive as $64,000 on Could 5.

Whereas the funding charge could appear low, it’s indicative of investor sentiment it's getting constructive. When the funding charge is constructive, merchants who’re lengthy pay a funding payment to merchants who’re quick. A rise on this funding charge signifies that extra merchants are prepared to pay extra to carry lengthy positions, which in flip might trigger the worth of the cryptocurrency to rise.

Supply: X

Equally, Clemente famous in his evaluation that Bitcoin's 3-month annualized charge is now beginning to transfer again up. The consequence of that is that extra traders can be prepared to purchase spot bitcoin whereas concurrently promoting a futures contract that expires in three months. Curiously, this annual charge is at present round 5% to 10% on Binance and Bybit, which is usually a bullish sign for a lot of traders.

Supply: X

The overall provide of stablecoins has began to rise once more, which might sign that traders are about to place cash into Bitcoin. In keeping with chain knowledge, the wallets maintain between 100 and 1,000 BTC elevated their purchases within the final two months.

Associated Studying: Dogecoin Holders Acquire Over 82%, What About Shiba Inu?

Regardless of the Bitcoin correction in April, these addresses continued to realize further Bitcoins. Analyst Willy Woo famous that an accumulation of this magnitude has by no means been seen for “excessive web price bitcoin holders” over a 2 month interval.

On the time of writing, Bitcoin is buying and selling at $62,350.

BTC value drops to $62,000 | Supply: BTCUSD on Tradingview.com

Featured picture from MarketWatch, chart from Tradingview.com