Whereas Bitcoin is usually thought-about a hedge in opposition to inflation, it has a optimistic inflation fee of 0.83%. Bitcoin inflation is extraordinarily low in comparison with the greenback's peak of 9.1% in 2022. Nonetheless, once we examine the cumulative inflation fee for each Bitcoin and the US greenback, we see the true energy of Bitcoin's position in preserving wealth.

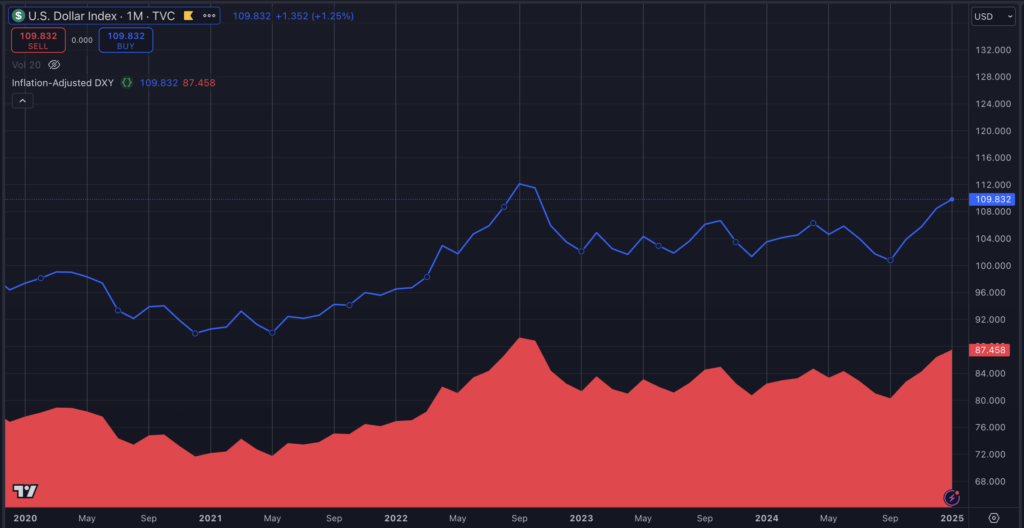

From 2020 to 2025, Bitcoin rose roughly 960%, whereas the US Greenback Index (DXY), which measures the US greenback in opposition to a basket of different currencies, rose nominally by simply 12%.

The inflation-adjusted value of Bitcoin and the inflation-adjusted DXY present important perception into the dynamics of the true worth of each property. Whereas the nominal DXY displays the relative power of the foreign money, its inflation-adjusted worth highlights the continued erosion of buying energy.

Nominal DXY presently stands at 109.8, reflecting international demand for the greenback amid macroeconomic uncertainty. Adjusted for cumulative US inflation from 2020 – averaging over 2% per yr and peaking above 8% in 2022 – the true DXY falls to 87.5. This represents a distinction of twenty-two.3 factors, or roughly 20.3% of nominal worth, illustrating the greenback's substantial lack of buying energy over time regardless of its relative power in opposition to different currencies.

In the meantime, the nominal value of Bitcoin is round $91,000. Adjusted for the supply's low inflation — 1.74% yearly from 2020-2024 and 0.83% in 2025 — its inflation-adjusted value is roughly $84,365. The $6,635 distinction is barely 7.3% of its face worth, highlighting bitcoin's relative stability and talent to take care of buying energy over time in comparison with fiat currencies. This minor adjustment highlights Bitcoin's programmed shortage and low inflation as key components in its resilience.

The distinction between the inflation-adjusted metrics for DXY and Bitcoin highlights the bigger story. Whereas fiat currencies just like the greenback face important devaluation attributable to inflation, Bitcoin's supply-driven forces place it as a hedge in opposition to foreign money depreciation. A extra pronounced inflationary affect on the DXY highlights the problem of sustaining buying energy within the fiat system, particularly in periods of excessive inflation.

The distinction between nominal and inflation-adjusted metrics is crucial to assessing the long-term worth of property. DXY's nominal power masks a basic erosion of the greenback's buying energy, whereas Bitcoin's inflation-adjusted value displays its skill to take care of worth over time. These findings strengthen the significance of inflation-adjusted analyzes within the improvement of efficient methods for orientation within the macroeconomic setting.

Inflation of the benchmark currencies used to find out DXY should even be taken into consideration with a view to decide the precise divergence. Nonetheless, the numbers above present a fundamental evaluation of Bitcoin's elevated power in opposition to the greenback above par.

Merely put, for those who invested $100 in Bitcoin in 2020 and $100 in DXY right now, your BTC would have a buying energy of $927, whereas your DXY could be equal to $91 in actual phrases.