Bitcoin's rise and subsequent fall from its new ATH of $108,200 has fueled fairly a little bit of market exercise. Final week's value volatility led to spikes in each spot and derivatives buying and selling, with rising volumes and sky-high liquidations indicating an aggressive market response to the worth drop.

Simply taking a look at buying and selling volumes can present a market in a scary selloff. Nonetheless, we will see that the response is proscribed to the retail market once we take into account modifications in OTC board balances.

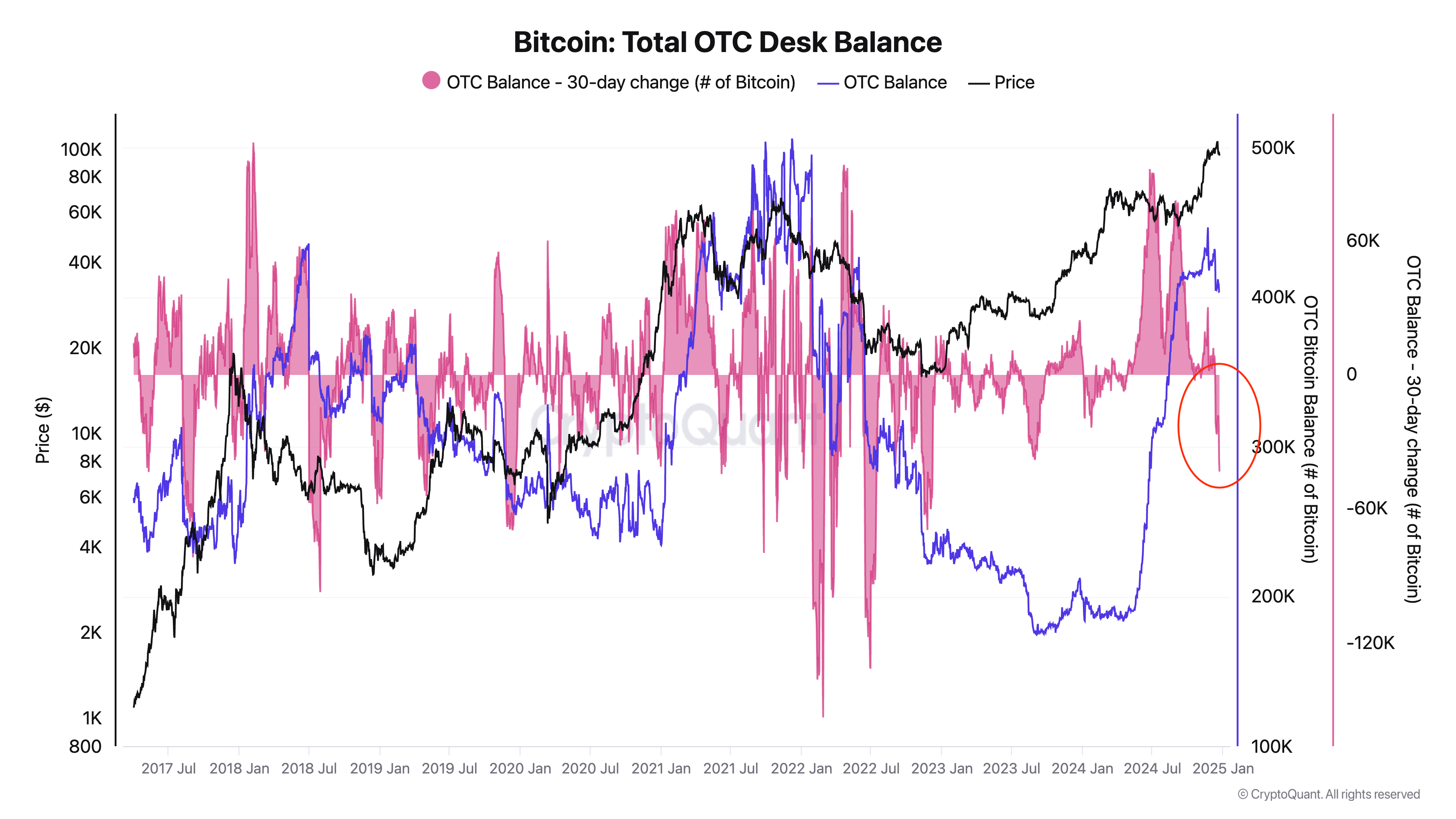

Information from CryptoQuant confirmed that the OTC desk steadiness noticed important outflows. OTC (over-the-counter) counters are platforms that facilitate massive trades instantly between consumers and sellers, bypassing public exchanges. Establishments and excessive internet value people typically use these desks to execute substantial trades with out inflicting important market disruption. Adjustments in OTC balances can present perception into the habits of those massive market members. When OTC balances lower, it typically alerts accumulation as buyers pull bitcoins off these desks, normally for chilly storage or strategic functions. Conversely, rising balances point out that fairly a little bit of BTC has been bought.

Nonetheless, there are issues with estimating OTC balances. Not all OTC desks report their knowledge, and the motion of bitcoins to and from these desks doesn’t all the time point out instant shopping for or promoting exercise. Regardless of these limitations, OTC steadiness traits stay a invaluable metric for gauging the sentiment and techniques of main market gamers.

This withdrawal of Bitcoin from the OTC desks is per the bigger story of whale and institutional accumulation. The declining OTC steadiness, particularly at the side of the numerous detrimental 30-day swing, means that these gamers are transferring Bitcoin off the platforms and certain into chilly storage. Such habits is usually indicative of long-term methods of accumulation, because it reduces liquidity in OTC markets and implies a tightening of provide.

Most of this decline occurred when the worth of Bitcoin fell from $108,200 to $94,000. And whereas this led to panic amongst retail buyers, the correction appears to have served as a significant shopping for alternative for big buyers. Giant buyers might have strategically used falling costs to build up bitcoins at what they understand to be a reduction. By pulling these property off the OTC counters, they’re signaling confidence within the long-term worth of Bitcoin regardless of short-term volatility.

A sustained discount in balances on OTC desks might result in provide constraints, which might put upward stress on the worth of Bitcoin within the medium to long run. This impact may very well be amplified if retail sentiment shifts again to optimism as Bitcoin breaks the $100,000 degree, fueling demand in a good provide market. Moreover, the exercise we've seen from establishments suggests strategic positioning forward of potential catalysts.

Institutional gamers seem to have used the worth drop as a possibility to build up, signaling confidence in Bitcoin's long-term trajectory. With provide tightening and demand doubtless rising, Bitcoin's present value ranges might present the idea for future progress.

The put up Drop in OTC Balances Exhibits Massive Traders Are Hoarding Discounted Bitcoin appeared first on fromcrypto.