The crypto market continues to face a pointy decline, falling round 10% within the final 24 hours following the newest Federal Reserve coverage replace.

Bitcoin value fell nearly 10% to hit a low of $93,000. That marks a pointy reversal from its latest excessive of $108,268 earlier this week.

The drop brings bitcoin to its lowest stage since mid-November, when it was using a bullish wave fueled by market optimism following Donald Trump's election victory.

Ethereum confronted a good steeper decline, falling almost 15% to hit $3,100 – its weakest place since late November.

Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE) and Cardano (ADA) additionally noticed double-digit losses, with information displaying drops of greater than 10%.

Market analysts attribute this huge selloff to the Federal Reserve's tightening stance on financial coverage. Though the Fed made the anticipated changes to borrowing charges, it lowered its forecast for charge cuts in 2025 from 4 to only two. This hawkish outlook has elevated strain on an already fragile market.

Moreover, the Federal Reserve clarified that it doesn’t plan to help any proposed authorities bitcoin reserve technique, additional dampening market sentiment.

Markus Thielen, head of analysis at 10x Analysis, stated that the present value stage of Bitcoin serves as a important indicator for threat administration. He famous that the Fed's hawkish stance and potential liquidity changes anticipated from the US Treasury in 2025 added to market uncertainty.

A liquidation frenzy is coming to the market.

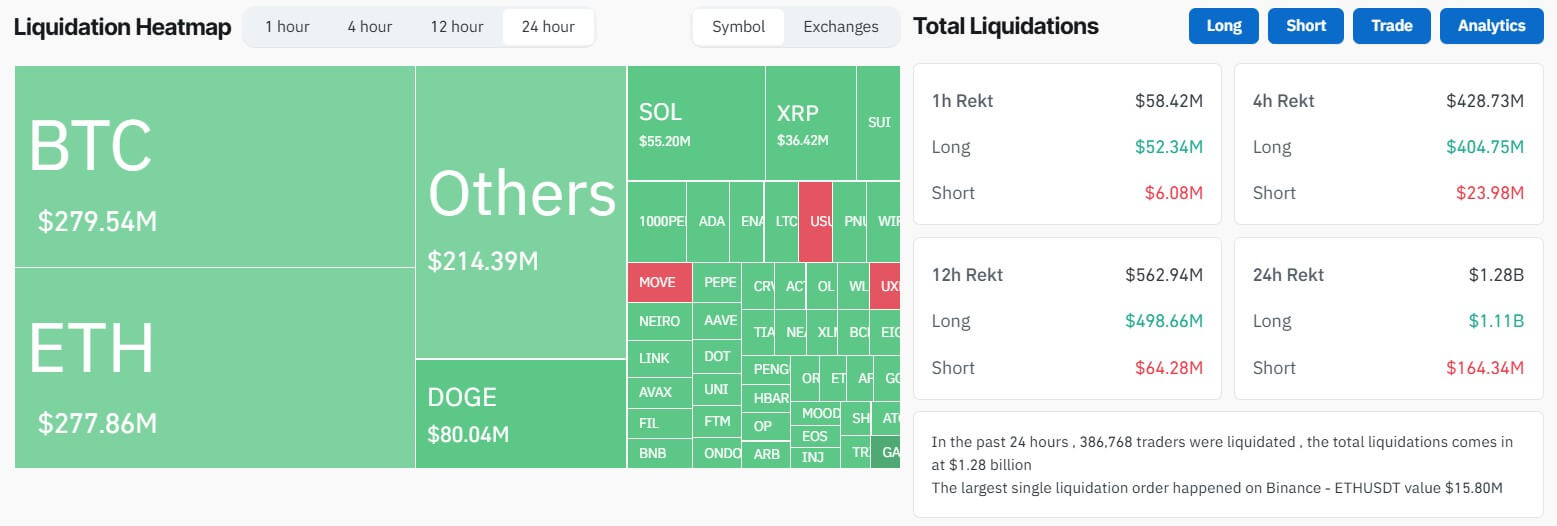

In accordance with information from CoinGlass, the latest market turbulence prompted greater than $1.2 billion in liquidations, affecting 377,618 merchants.

Lengthy merchants — these betting on value will increase — bore the brunt of the losses, dropping about $1.07 billion. This represents probably the most important setbacks for lengthy merchants this 12 months.

In the meantime, quick merchants betting on falling costs misplaced $163 million in the course of the interval underneath evaluate.

Bitcoin value speculators suffered probably the most important losses, with $279 million liquidated, together with $227.5 million in lengthy positions. Ethereum merchants adopted intently behind with $277 million in liquidations, together with $248.7 million in lengthy positions and $28.2 million in brief positions.

Merchants betting on Solana, XRP, and Dogecoin additionally suffered losses of $55 million, $36 million, and $80 million, respectively.

Essentially the most important single liquidation happened on Binance, involving a $15 million ETH-USDT transaction, additional highlighting the depth of latest market volatility.