Bitcoin's worth has seen a pointy decline following the current US Federal Reserve charge reduce, however market specialists like Bitwise CIO Matt Hougan stay bullish on the asset's long-term trajectory.

On December 18, the Federal Reserve introduced a 25 foundation level charge reduce, reducing its outlook for 2024 to 2 cuts as a substitute of the beforehand anticipated 4.

Additionally, and maybe extra considerably for Bitcoin, Chairman Jerome Powell added that the Fed can’t maintain BTC beneath present laws whereas answering questions on President-elect Donald Trump's Reserve Fund strategic plans.

This prompted vital market reactions, with the worth of Bitcoin falling as little as $98,839 earlier than stabilizing at $101,586 immediately. Equally, different high digital belongings resembling Ethereum, XRP and Solana additionally noticed losses of round 5%, 5.5% and three% respectively.

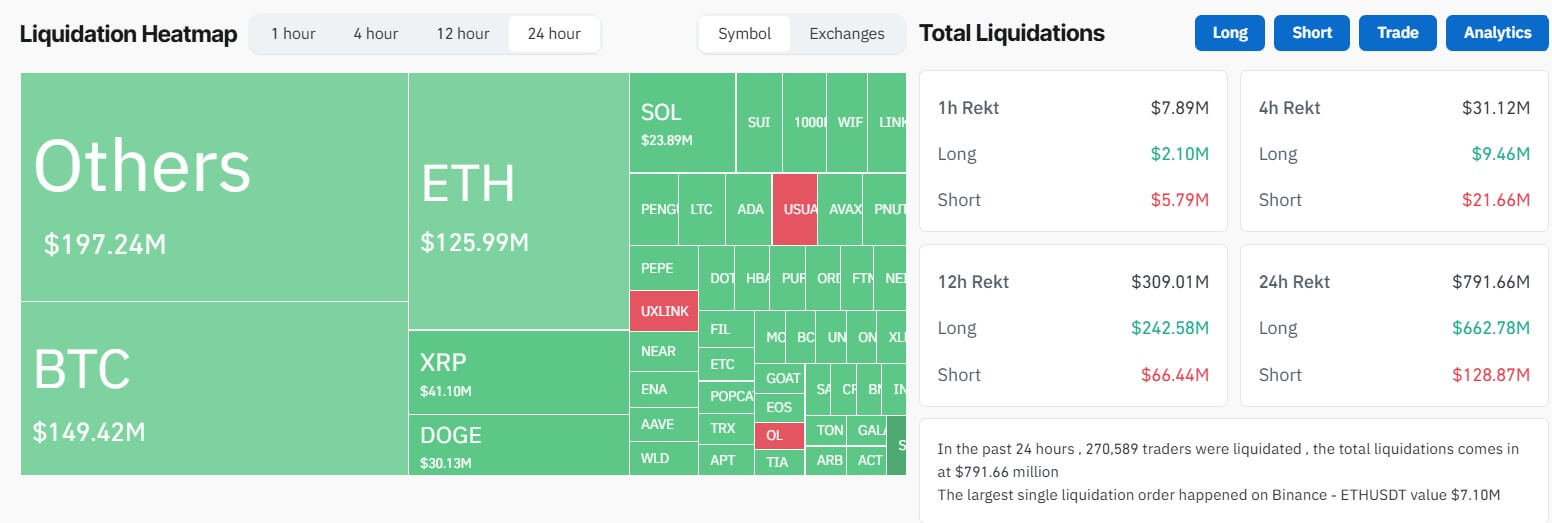

Information from CoinGlass exhibits that this crimson market efficiency resulted within the liquidation of roughly $800 million, affecting greater than 270,000 merchants. Merchants speculating on an upward worth motion suffered essentially the most losses, shedding $662 million within the final 24 hours.

Along with cryptocurrencies, conventional markets such because the S&P 500 and the Russell 2000 Index had been down 3% and 4.4%, respectively.

Bitcoin's Lengthy-Time period Trajectory

Regardless of this decline, Hougan assured traders that bitcoin's fundamentals stay sturdy.

The Bitwise CIO defined that bitcoin's current resilience stems from inner crypto-specific components resembling rising institutional adoption, pro-crypto shifts in US coverage, and authorities and company purchases of bitcoin.

He additionally highlighted vital advances in blockchain and rising ETF flows as different drivers of market energy.

Moreover, Bitcoin's technical indicators stay bullish, with its 10-day EMA ($102,000) nonetheless above its 20-day EMA ($99,000). Hougan sees this as a bullish sign that reinforces his perception that the present decline is a short-term fluctuation somewhat than the top of an ongoing bull market.

Regardless of exterior pressures, Hougan predicted that bitcoin will proceed its multi-year upward trajectory, supported by sturdy adoption developments and technological developments within the crypto area.

He concluded:

“Cryptocoins are in a multi-year bull market.” The anticipated 50 bps charge reduce won’t change that.”