- VIRTUAL's 16% worth drop follows a bull rally pushed by AI agent hype and listings on main exchanges.

- The decline is because of revenue taking and overbought market as indicated by the RSI.

- This pullback might supply a shopping for alternative for brand spanking new traders.

In a stunning flip of occasions, the Virtuals protocol token, VIRTUAL, has seen a exceptional 16% drop up to now 24 hours, falling to $2.60 at press time.

This market calm follows a dramatic bull run that noticed VIRTUAL soar to a brand new all-time excessive of $3.30 on December 16, 2024.

The decline raises questions on whether or not the bull run is over or only a short-term dip in a bigger pattern.

What precipitated the Virtuals Protocol (VIRTUAL) to collect within the new ATH?

Earlier than diving into whether or not the decline indicators the top of the bullish momentum, it could be necessary to first perceive what was behind the current rally.

VIRTUAL's current worth rally may be traced again to a collection of bullish catalysts and the broader market pattern.

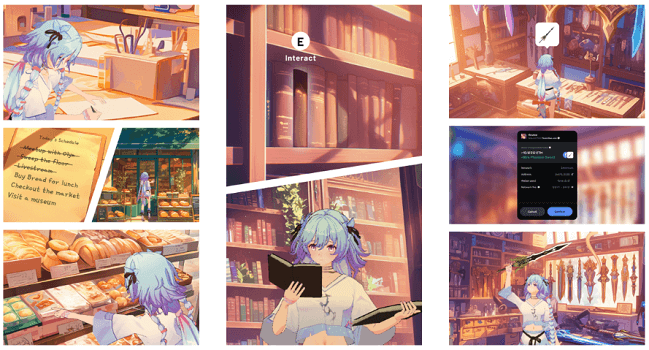

First, Virtuals Protocol, a man-made intelligence and metaverse challenge, is gaining recognition as one of many hottest belongings within the crypto market, particularly amid the rise of AI brokers and AI-powered autonomous software program. The challenge's give attention to co-ownership of AI brokers, which permits customers to create or use current tokens, has attracted appreciable consideration, resulting in a rise in demand for VIRTUAL tokens and a corresponding enhance in costs.

As well as, pleasure surrounding the Virtuals Protocol launchpad performance, which permits customers to create AI brokers and related tokens, has added to the hype. The expansion of AI-powered interactions, as evidenced by viral success tales like Terminal of Truths on X, has contributed to the widespread adoption of VIRTUAL.

AI brokers have develop into the brand new frontier within the crypto house, with the worth of the related tokens skyrocketing because the market sees large and viral interplay with AI protocols, purposes, and different brokers.

AI brokers on Solana 🤖

AI Agent ecosystem on @solana thrives on distinctive tasks equivalent to #ai16z , #Digital and others. 🌐

With a market cap exceeding $10 billion, AI brokers are merging #DeFi and #AIwhich paves the way in which for decentralized automation. That is just the start.

AI… https://t.co/rk6a4QtkAi pic.twitter.com/pS777PFwni

— Solana Each day (@solana_daily) December 14, 2024

Second, the rally started in early December 2024, coinciding with key developments inside the ecosystem.

On December 11, OKX, one of many main crypto exchanges, introduced the launch of VIRTUAL/USDT perpetual futures, rising liquidity and availability for merchants. It was rapidly adopted by Hyperliquid, a decentralized layer 1 buying and selling platform that added assist for VIRTUAL and allowed as much as 5x leveraged buying and selling.

Binance, the world's largest crypto alternate by quantity, has additionally joined the pattern by including assist for VIRTUAL futures buying and selling.

These listings gave traders further alternatives to realize publicity to VIRTUAL, rising demand and considerably rising the value of the token.

Why is the VIRTUAL worth happening? Is it the top of the rally?

The present VIRTUAL decline in worth may be largely attributed to revenue taking and the market cooling off after an prolonged bull run.

The token has entered overbought territory based on the 14-day Relative Energy Index (RSI), which rose above 83 on December 16. This overbought situation typically indicators {that a} correction or consolidation section is underway, prompting merchants to take earnings and doubtlessly result in a worth decline as provide catching up with demand.

Though the RSI has since dropped to round 71.36, it nonetheless signifies that the market continues to be overbought and will see additional declines earlier than stabilizing.

This pullback isn’t uncommon within the crypto market, the place speedy worth progress can result in important corrections.

Apparently, whereas the sudden drop in worth is disappointing to some, it might present a chance for brand spanking new traders to enter the market at a extra favorable entry level.