Bitcoin, which hit an all-time excessive of $107,000, displays the robust bullish sentiment available in the market over the previous two months.

To know what has induced the sustained upward momentum this yr, we will flip to the True Market Median Worth (TMMP) and the AVIV ratio. These on-chain indicators make clear investor habits and supply perception into cost-based traits.

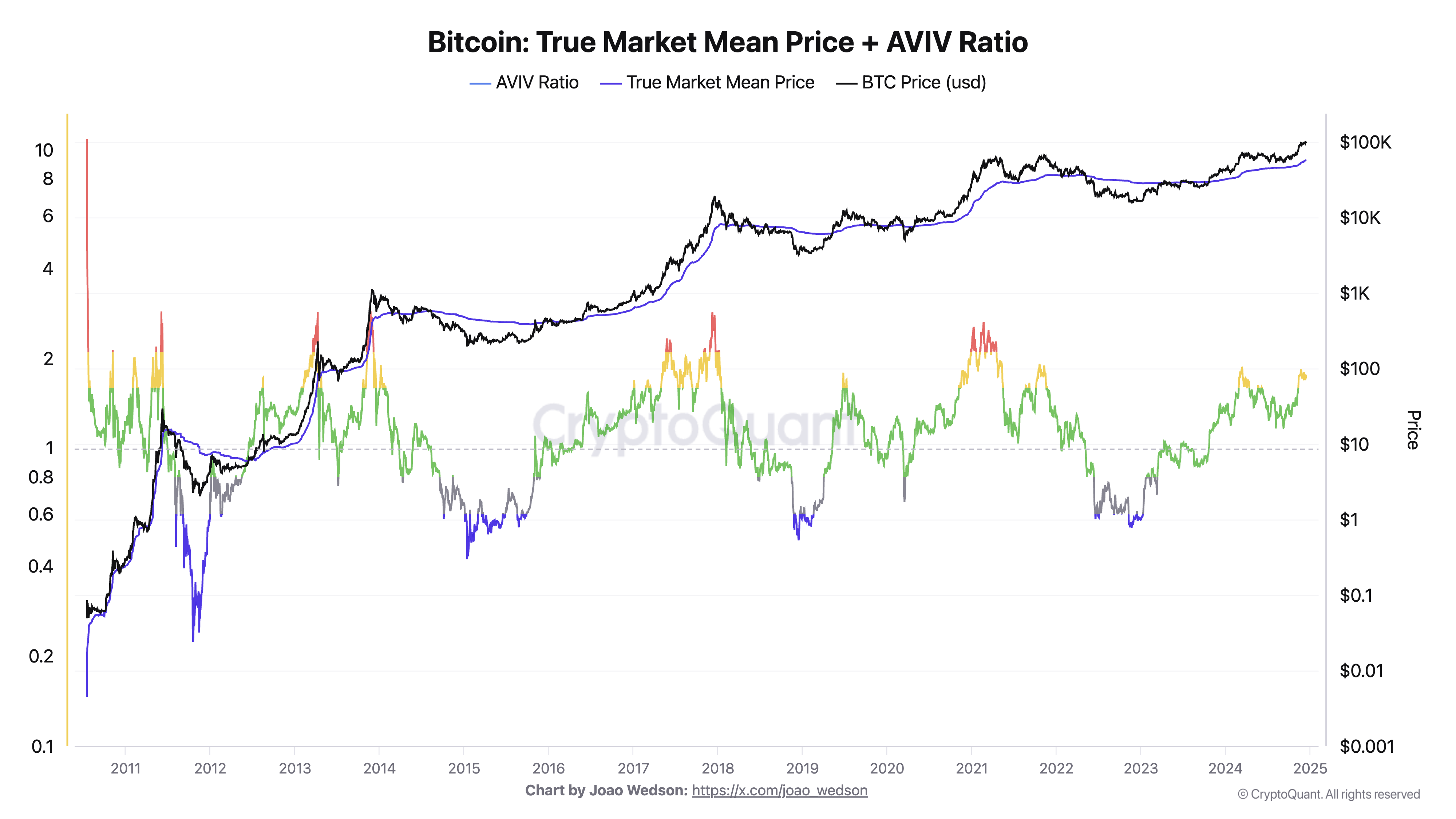

True Market Median Worth (TMMP) is the typical acquisition worth for the market, calculated by dividing the investor cap by the lively bid. It excludes miner revenue realization as a way to isolate investor-driven acquisition traits and measure the price base of Bitcoin within the secondary market. The AVIV ratio is usually analyzed together with TMMP, which represents the ratio of lively market valuation to realized valuation. It measures how far present market costs have deviated from the realized price foundation and signifies potential overbought or oversold situations. The AVIV ratio is usually used to determine alternatives or dangers in worth volatility.

Whereas TMMP has all the time had a constant upward pattern, modifications in its progress price may help make clear market habits. The true market common worth has progressively elevated over the yr following the rise within the worth of Bitcoin. The correlation between worth will increase and TMMP implies that greater costs had been supported by sustained market curiosity. Because the yr progressed, the hole between the value of Bitcoin and TMMP widened considerably, displaying buyers important unrealized good points. This unfold has traditionally been seen throughout mature bull markets, typically earlier than durations of elevated volatility or corrections.

The AVIV ratio was at reasonable ranges initially of 2024, according to the market being in an accumulation part. In the course of the yr, as the value of Bitcoin superior, the ratio climbed greater, reflecting rising investor earnings and a strengthening market. In December, the ratio reached a stage traditionally related to overheated market situations, much like these seen in 2013, 2017 and 2021. Such jumps within the ratio happen when the market worth of Bitcoin considerably exceeds the realized valuation, signaling that the market could also be nearing a neighborhood high.

Information from CryptoQuant exhibits an fascinating sample – 2024 noticed relative stability within the ratio of AVIV to TMMP in comparison with earlier years. This means that the market is maturing and turning into extra environment friendly, with much less excessive swings in acquisition prices. Traditionally, important swings within the AVIV to TMMP ratio typically adopted sharp worth actions that preceded bear markets. Nonetheless, the diminished volatility of the AVIV and TMMP ratio throughout 2024 means that investor habits is turning into extra constant and helps a extra resilient market construction.

Whereas the rise in TMMP indicators long-term investor confidence, the elevated stage of the AVIV indicator highlights the short-term dangers of a correction. Traditionally, durations when the AVIV ratio has exceeded 2 have been adopted by worth retracements because the market weighs on profit-taking pressures. December 2024 displays these historic traits with rising AVIV ranges and a big deviation from TMMP, indicating a possible cooling part forward. Nonetheless, continued institutional curiosity and a rising derivatives market counsel that this cooling part is unlikely to be long-term or notably aggressive.

Investor habits in 2024 helps this evaluation. A constant enhance in TMMP means that buyers are hoarding bitcoins at greater costs, rising the general market price base. On the similar time, the sharp enhance within the AVIV indicator from the top of the yr signifies profit-taking exercise because the market surged to new highs. This mix of accumulation and realized good points displays a wholesome bull market construction, however cautions in opposition to a doable short-term correction.

Publish-AVIV Ratio Rises as Bitcoin Hits New ATH appeared first on fromcrypto.