Bitcoin's efficiency over the previous week has been exceptional, marked by its milestone of breaking the $100,000 mark.

Whereas this monumental degree was short-lived and BTC rapidly corrected to round $91,000 earlier than rebounding to round $97,000, it stays a big achievement. Since first crossing the milestone, Bitcoin has crossed the $100,000 mark a number of instances, suggesting that it’s already failing as help or resistance. The market's capability to maintain these elevated ranges is proof of sturdy underlying demand for BTC.

The truth that Bitcoin didn’t expertise a pointy selloff or return to cost ranges beneath $90,000 after failing to consolidate above $100,000 is a robust indicator that the promoting strain is being met by equally sturdy, if not stronger, shopping for curiosity. At this degree, demand stays sturdy sufficient to counter any makes an attempt to decrease the worth. Costs round $94,000 confirmed sturdy help, with a number of wicks as much as these ranges earlier than bouncing again.

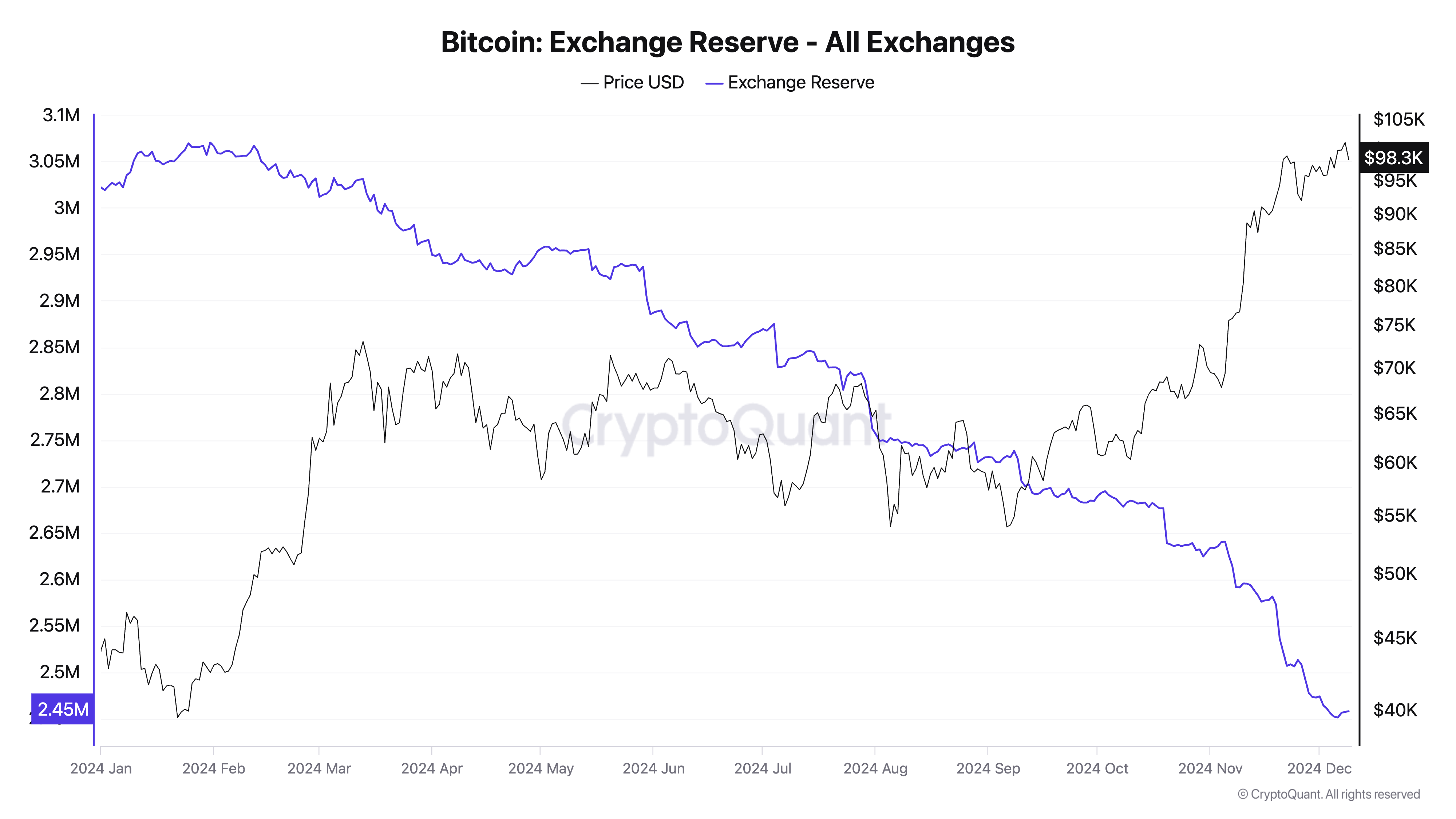

This stability between provide and demand is obvious when inspecting the connection between overseas change reserves and overseas change internet flows. International change reserves – bitcoins held on centralized platforms – have been steadily declining over the long run and now stand at round 2.45 million BTC.

This development displays a transparent choice amongst market members to maneuver bitcoins into private wallets or chilly storage, signaling confidence in bitcoin's long-term worth. Falling reserves cut back the availability of bitcoins out there for instant sale, which often promotes worth stability or upward motion.

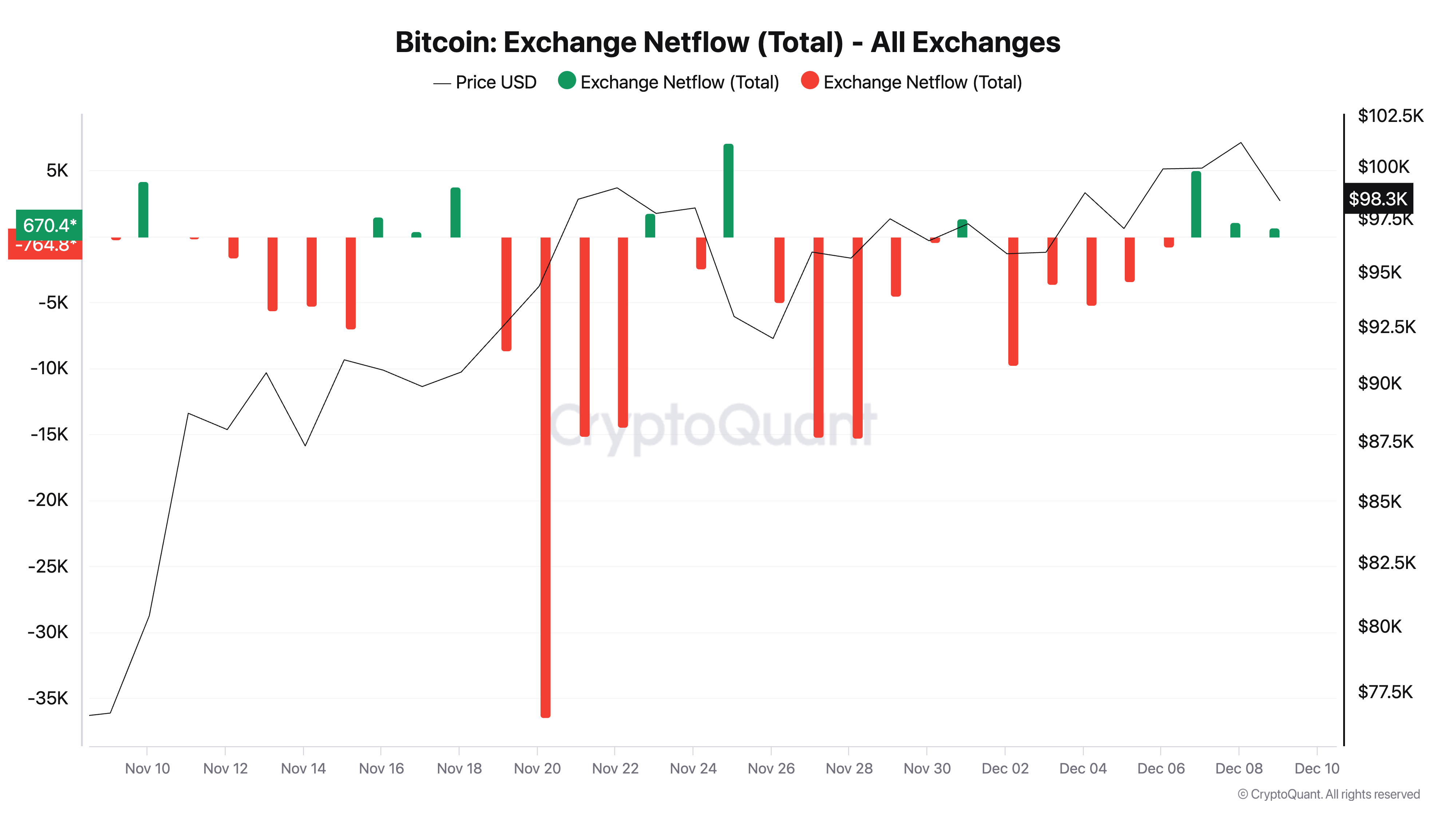

In distinction, overseas change internet flows paint a barely completely different image within the brief time period. Netflows, which measure the distinction between inflows and outflows of bitcoins to exchanges, have proven occasional spikes in inflows over the previous week. These jumps recommend that some buyers are transferring bitcoin again into exchanges, prone to take earnings after current worth will increase or to hedge their positions.

Nonetheless, these inflows didn’t translate into vital downward strain on the worth. This corresponds to the earlier one fromcrypto evaluation that discovered that a good portion of the downward worth motion comes from the derivatives market.

Because of this nearly all of bitcoins deposited on exchanges are absorbed by patrons, stopping any substantial drop in worth. The distinction between declining long-term reserves and sporadic short-term inflows highlights a balanced market the place the forces of provide and demand are evenly matched.

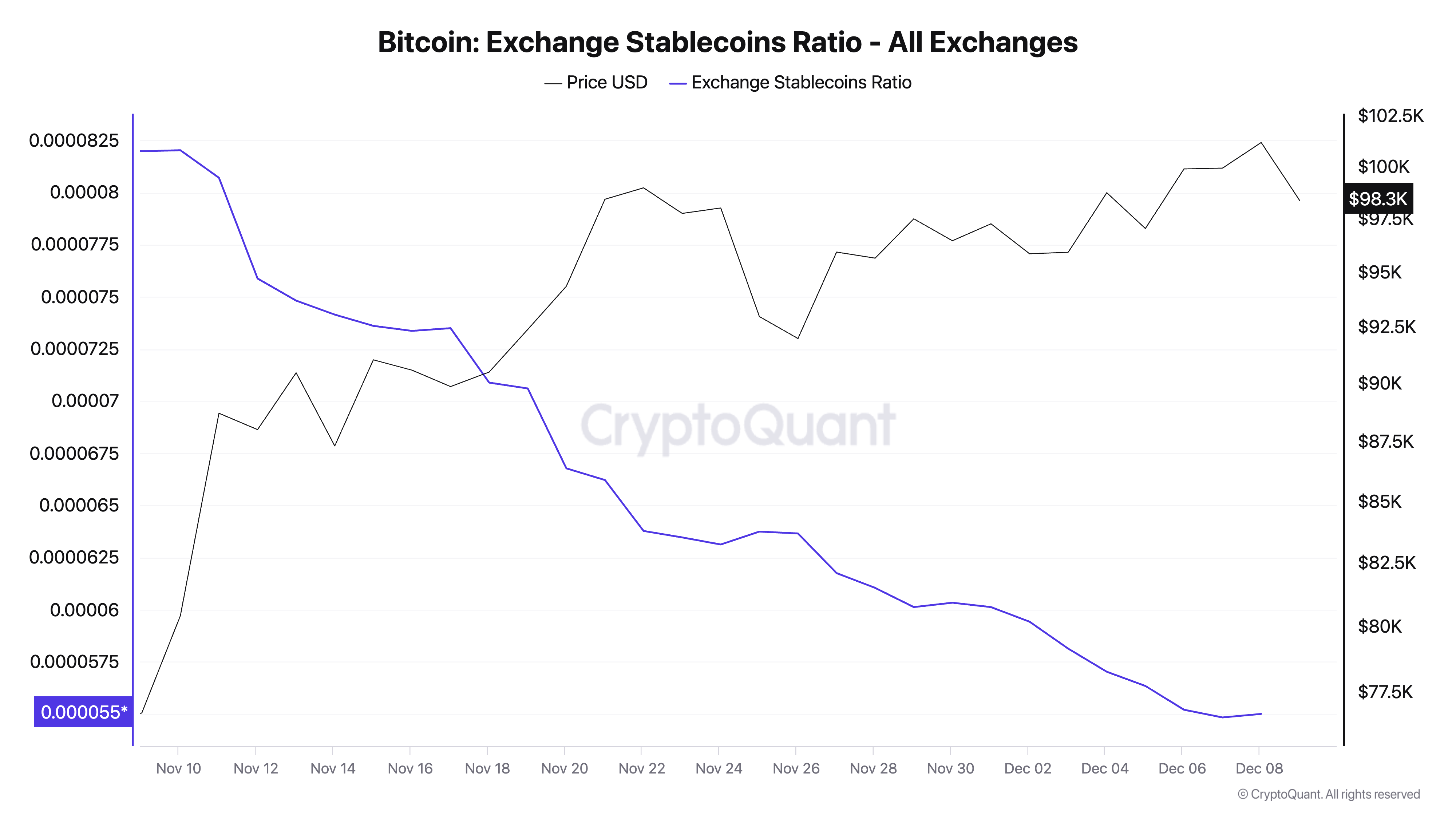

The sturdy shopping for strain is additional confirmed by trying on the change ratio of stablecoins. Beforehand analyzed by a person fromcryptothis metric measures the quantity of Bitcoin reserves relative to stablecoin reserves held on exchanges. A decrease ratio signifies the next proportion of stablecoins, which signifies that the exchanges are properly capitalized with buying energy.

With the ratio of stablecoins on the change presently at an all-time low, we will see that the market is flush with liquidity and able to take in any promoting strain from the exchanges. The massive variety of stablecoins out there on exchanges permits the market to keep up demand for Bitcoin regardless of elevated promoting exercise – corresponding to we noticed when BTC crossed $100,000.

The low ratio of stablecoins enhances the developments of overseas change reserves and internet flows. Whereas reserves present a structural decline in out there bitcoins and internet flows spotlight short-term promoting makes an attempt, the abundance of stablecoins confirms that there’s sufficient capital to soak up these gross sales.

Collectively, these metrics paint an image of a market properly supported by liquidity, even because it strikes by means of profit-taking intervals. This liquidity probably saved Bitcoin between $95,000 and $99,000 regardless of its incapacity to recapture $100,000.

Declining overseas change reserves level to a discount in promoting liquidity in the long run, creating potential strain on provide. On the similar time, the presence of stablecoins alerts that purchasing curiosity shouldn’t be solely current, however vital sufficient to counter promoting makes an attempt.

Web flows act as a real-time measure of short-term sentiment, and the truth that the influx didn’t result in a worth collapse additional confirms the power of demand. This creates a suggestions loop the place promoting strain is mitigated by the liquidity offered by stablecoins, whereas dwindling reserves be certain that even average demand can considerably have an effect on the worth.

The submit Bitcoin Holds Steadily Close to $100,000 As Promoting Strain Is Absorbed appeared first on fromcrypto.