- The $0.4250 POL assist stays important for stability amid decreased buying and selling quantity.

- SAND faces $0.3350 as key assist, with declining quantity signaling decrease momentum.

- AAVE is consolidating assist close to $161.00 and eyeing a possible breakout round $165.00.

Polygon (POL) is holding regular at $0.37 regardless of the current decline, whereas The Sandbox (SAND) and Aave (AAVE) are dealing with bearish stress. Let's see if these altcoins can get better and comply with Polygon's lead.

Polygon (POL) Navigation in an unstable panorama

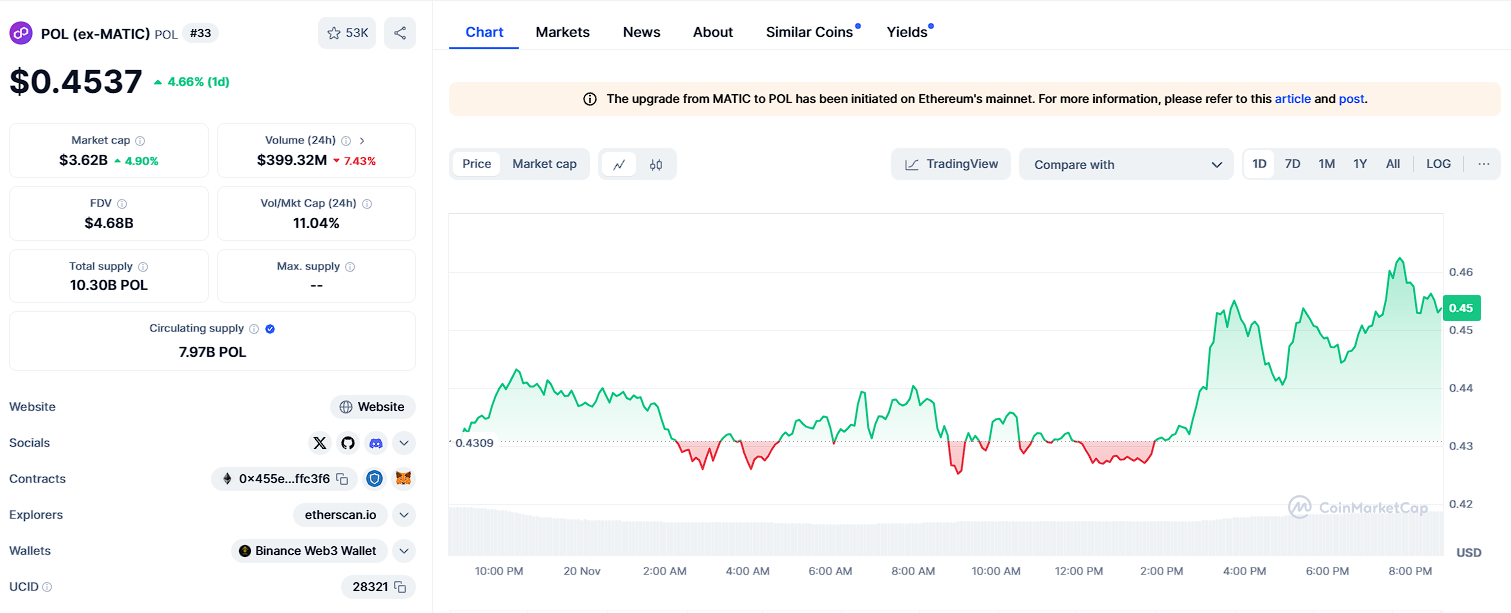

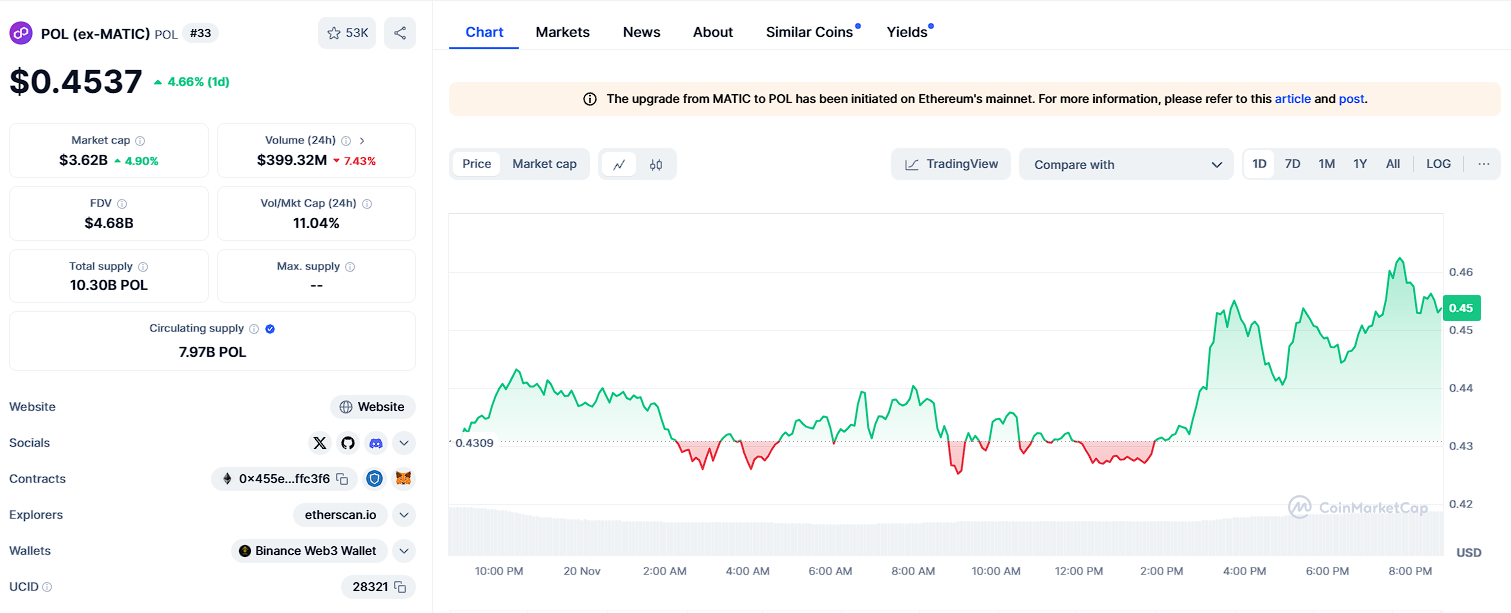

POL value confronted downward stress, at present buying and selling at $0.4537, up 5.50% for the day.

Considerably, $0.4400 acts as robust resistance, adopted by $0.4350, limiting upside momentum through the restoration. On the upside, $0.4250 serves as key assist, whereas $0.4200 might emerge as a ground if bearish sentiment persists.

Supply: CoinMarketCap

Consequently, a maintain above $0.4250 might assist consolidation within the $0.4300-$0.4350 vary. Nevertheless, a break of $0.4250 might result in additional declines. A 26.10% lower in quantity and a 2.32% lower in market capitalization spotlight the decreased exercise.

Sandbox (SAND) struggles with continued downward stress

SAND struggled to keep up its upward momentum, buying and selling at $0.3402 after a 1.99% decline. The value initially examined $0.3477 however bumped into robust promoting stress resulting in a sustained decline. Resistance lies at $0.3477 and $0.3450, whereas $0.3350 gives important assist, with $0.3300 appearing as potential aid if bearish traits proceed.

Excessive intraday volatility underscores lively buying and selling, though sustained momentum stays elusive. A major decline in buying and selling quantity of 34.07% and a decline in market capitalization of 1.90% replicate cooling sentiment out there.

A maintain above $0.3350 might stabilize SAND and permit consolidation between $0.3400 and $0.3450. Conversely, a break under $0.3350 might set off one other rejection.

Aave (AAVE) Ready for Breakout in slender vary

AAVE is buying and selling at $162.89, reflecting a slight lower of 0.64%. The value reached $163.93 earlier than retracing and exhibiting range-bound conduct. Resistance at $163.93 and $165.00 signifies robust vendor exercise, whereas assist at $161.00 and $159.50 gives a security web.

A 9.43% drop in buying and selling quantity and a slight drop in market capitalization to $2.44 billion underscore the restricted exercise. A maintain above $161.00 might permit AAVE to retest $163.93 and probably transfer above $165.00. Nevertheless, a failure to carry $161.00 might set off a transfer in the direction of $159.50

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shall not be answerable for any losses incurred on account of the usage of mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.