- Bitcoin is rising to turn into the world's main asset, outperforming commodities and main know-how corporations.

- Institutional demand and ETFs are fueling Bitcoin's progress and rising market presence.

- Bitcoin is approaching key milestones, displaying sturdy momentum and potential for future progress.

Bitcoin has turn into the world's eighth largest asset by market capitalization. At $1.786 trillion, Bitcoin ranks forward of conventional commodities like silver and firms like Meta Platforms.

In line with IntoTheBlock, Bitcoin ranks among the many main international property, behind gold, Apple, NVIDIA, Microsoft, Alphabet (Google), Amazon and Saudi Aramco. Gold leads with a market capitalization of $17.526 trillion and a unit worth of $2,610. Know-how corporations dominate the highest, with Apple valued at $3.428 trillion, NVIDIA at $3.401 trillion, and Microsoft at $3.085 trillion.

Bitcoin is value greater than silver, which has a market cap of $1.746 trillion, and the Meta platform, which is value $1.400 trillion. Saudi Aramco Surpasses Bitcoin With $1.792 Trillion Valuation.

Institutional curiosity is driving Bitcoin's progress

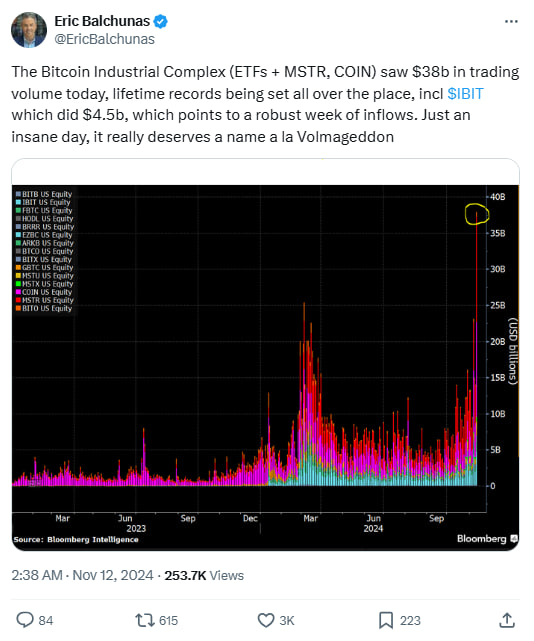

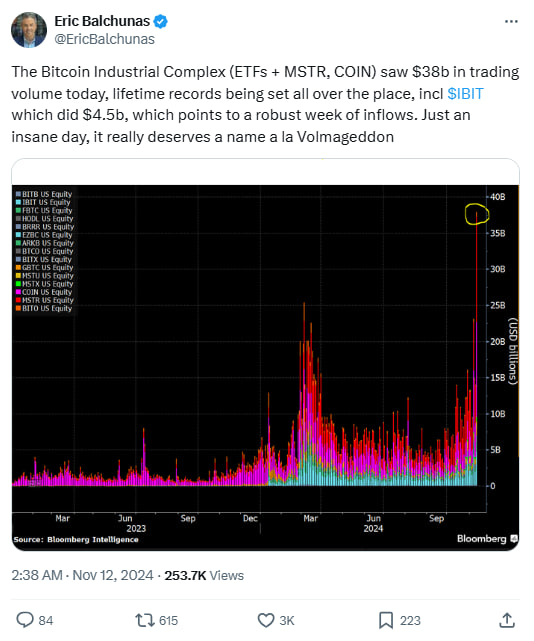

Eric Balchunas, chief ETF analyst at Bloomberg, famous that institutional curiosity and rising adoption of bitcoin exchange-traded funds (ETFs) have fueled the rise in bitcoin's market capitalization.

BlackRock's iShares Bitcoin Belief (IBIT) noticed $4.5 billion in buying and selling quantity, signaling elevated institutional participation. As well as, the broader Bitcoin ecosystem, together with ETFs, MicroStrategy and Coinbase, reached a document buying and selling quantity of $38 billion.

Additionally Learn: Bitcoin Breaks Data: Surpasses Silver In Market Cap, $145 Billion Traded In 24 Hours! Is there one other $100,000?

Bitcoin's Path to $100,000

Bitcoin's latest rally noticed its worth climb to $91,642.63, representing a 1.22% acquire over the previous 24 hours and a 3.90% acquire over the previous seven days. With a circulating provide of 20 million BTC, its market capitalization now stands at $1.813 trillion.

The crypto asset hit an all-time excessive of $88,000 earlier this yr, placing it inside attain of the six-figure milestone.

Regardless of its spectacular progress, Bitcoin stays smaller than gold, which boasts a market capitalization of practically 10 instances its dimension. The Kobeissi Letter, a monetary markets commentary, pointed to this distinction and highlighted the potential for Bitcoin to develop additional within the coming years.

Disclaimer: The knowledge supplied on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shall not be accountable for any losses incurred because of using mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.