- MicroStrategy Expands Bitcoin Holdings With Enormous Purchases, Strengthening Its Portfolio.

- Bitcoin value rises to new highs, supported by MicroStrategy's daring shopping for technique.

- MicroStrategy is funding bitcoin investments by share gross sales and persevering with its funding plan.

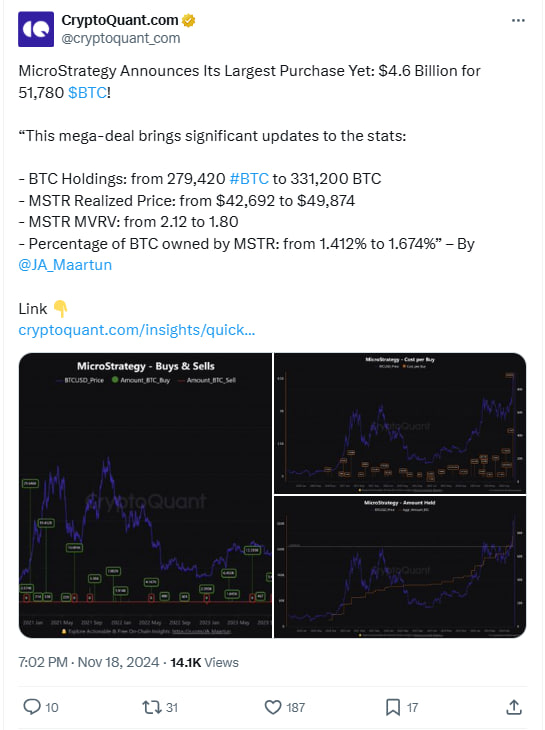

MicroStrategy simply made historical past with one of many largest Bitcoin purchases ever, shopping for 51,780 BTC for $4.6 billion. Much more exceptional, your entire buy was made in a single week at a mean value of $88,627 per Bitcoin.

This newest buy brings MicroStrategy's whole Bitcoin holdings to 331,200 BTC, up from the earlier 279,420 BTC, at a mean value of $49,874 per coin.

The market worth to realized worth (MVRV) ratio moved from 2.12 to 1.80, displaying the affect of this huge quantity buy on portfolio metrics. Notably, MicroStrategy now owns roughly 1.674% of the circulating provide of Bitcoin, up from 1.412%.

MicroStrategy's Bitcoin Mining Technique

MicroStrategy financed this buy by the sale of shares. Between November 11 and 13, the corporate bought 13.6 million shares and raised $4.6 billion.

Regardless of the dimensions of that deal, MicroStrategy nonetheless has $15.3 billion value of inventory accessible on the market, in line with SEC filings. Earlier this 12 months, MicroStrategy acquired 27,200 BTC for $2 billion at a mean value of $74,463 per coin.

These property have already made a revenue of practically $200 million, underscoring the effectiveness of its systematic method to leveraging capital for bitcoin investments.

Bitcoin costs

MicroStrategy's newest transfer coincided with Bitcoin breaking by the $90,000 stage for the primary time on November 12, later reaching $92,400. Bitcoin is at the moment priced at $89,782.54, reflecting a weekly achieve of 9.74% regardless of a smaller every day decline of 0.84%.

Additionally learn: Microstrategy to take a position $42 billion extra in Bitcoin

With a market cap exceeding $1.77 trillion and a 24-hour buying and selling quantity of $59.6 billion, Bitcoin continues to see robust exercise.

Disclaimer: The data supplied on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shall not be accountable for any losses incurred on account of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.