Michael Saylor's MicroStrategy made its largest buy of Bitcoin up to now, buying 51,780 BTC for $4.6 billion at a median buy worth of $88,627 per coin, in response to a Nov. 18 submitting with the U.S. Securities and Trade Fee (SEC).

The transfer comes only a week after the agency purchased 27,200 BTC for $2.03 billion. Mixed, these transactions convey the corporate's whole bitcoin purchases for November to just about 80,000 BTC, value over $6.6 billion.

These aggressive BTC purchases boosted its whole Bitcoin holdings to three,331,200 BTC, which the corporate acquired for $16.5 billion at a median worth of $49,875 per coin. At present costs, these property are value round $30 billion.

The agency stated its newest buy pushed its BTC yield to 41.8% year-over-year. Bitcoin yield is a elementary KPI that an organization makes use of to measure how its BTC funding technique is impacting its shareholders.

Nevertheless, regardless of the size of this acquisition, MicroStrategy's share worth noticed minimal motion. Pre-market buying and selling knowledge from Google Finance reveals a slight improve of 0.23%.

MicroStrategy vs Bitcoin ETF

In the meantime, the newest bitcoin buy means MicroStrategy has purchased extra of the highest cryptocurrency this month than the entire US exchange-traded spot bitcoin funds.

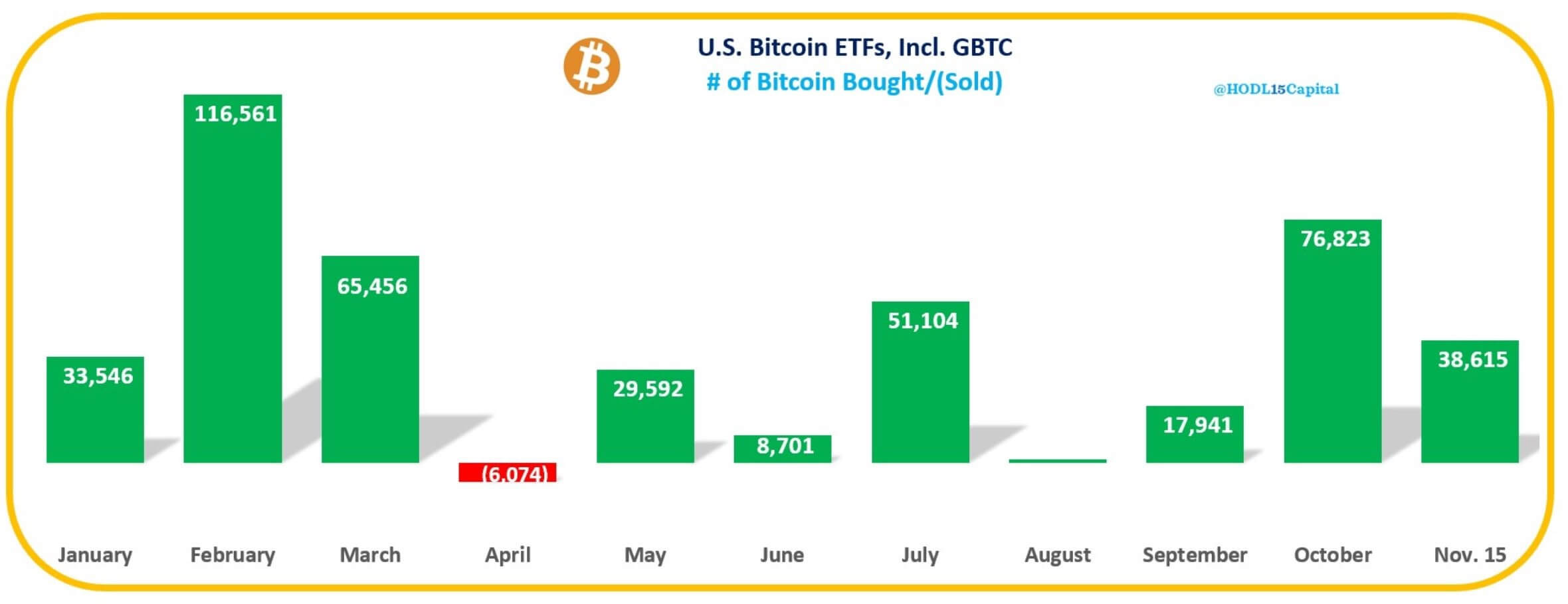

Information collected by HODL15Capital reveals that these high-flying BTC-related monetary devices raised 38,615 BTC as of November 15. BlackRock's IBIT led acquisitions throughout this era, shopping for over 37,000 BTC.

Unsurprisingly, MicroStrategy's BTC buy technique has attracted appreciable market consideration because it has modified the software program agency's monetary construction and positioned it as a distinguished proponent of digital asset adoption.

Market watchers identified that the corporate's company money reserve now exceeds all however 14 firms within the S&P 500, equivalent to iPhone maker Apple and Google father or mother Alphabet.