- Bitcoin will print its final ATH of this cycle in This fall 2025.

- Analyst Ignas mentioned that the bull cycle for BTC is much from over.

- Trump as president may result in a “MEGA CRAZY bull run.”

Bitcoin (BTC) hit an all-time excessive of $93,434.36 on Thursday earlier than falling 1.42% to fall under $90,000. Regardless of the decline, crypto analyst Ignas predicts that BTC will attain a brand new all-time excessive in This fall 2025 and proceed its established market cycles.

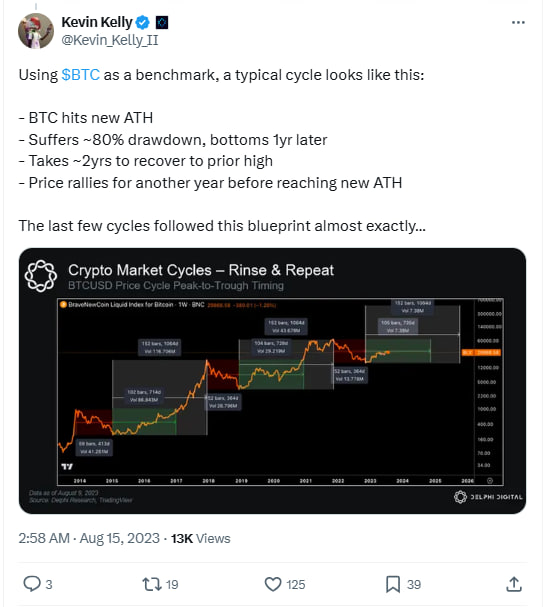

In accordance with a submit on X by Ignas, the BTC cycle was predicted in 2023 by Delphi Analysis, a digital asset analysis agency, and market watchers have been following the trail ever since. Talking concerning the market's value predictions, Ignas mentioned: “BTC goes up, ETH, SOL and different massive caps observe and all the things else (in all probability most memecoins) months.”

Moreover, the analyst highlighted the potential for a “MEGA CRAZY bull run” within the crypto market after pro-crypto candidate Donald Trump wins the 2024 US presidential election. Trump's promise of crypto-friendly laws may act as a catalyst to extend cryptocurrency adoption, boosting the market.

Additionally Learn: $181 Billion Stablecoin Market Laying the Groundwork for $100,000 Bitcoin?

Within the submit, Ignas identified that Bitcoin has weathered bearish challenges, together with an outflow of grayscale ETFs, FUD dumping on Mt. Gox and US election uncertainty. These obstacles, mixed with international rate of interest cuts, set the stage for a promising bull part.

Ignas predicted that BTC will maintain a year-long rally through which the value and better highs of the coin will rise, adopted by a correction part through which costs will fall till it bottoms out.

Bitcoin value surged after Trump's victory

The worth of Bitcoin reacted positively to Trump's election victory, rising nearly 9% on November sixth and 4.82% on November tenth. Afterward November 11, the main digital asset rose 10.30% and broke $93,000 on November 13.

Bitcoin rallied 16.25% over the previous week, adopted by a whopping 31.90% acquire over the previous 30 days, in response to knowledge from CoinMarketCap. The Relative Power Index (RSI) is 75, which implies the digital asset is overbought. Additionally, demand for BTC is extraordinarily excessive as investor sentiment stays bullish.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shall not be answerable for any losses incurred on account of the usage of mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.