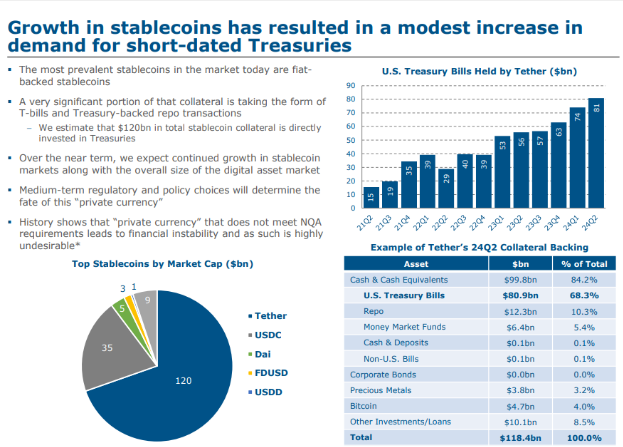

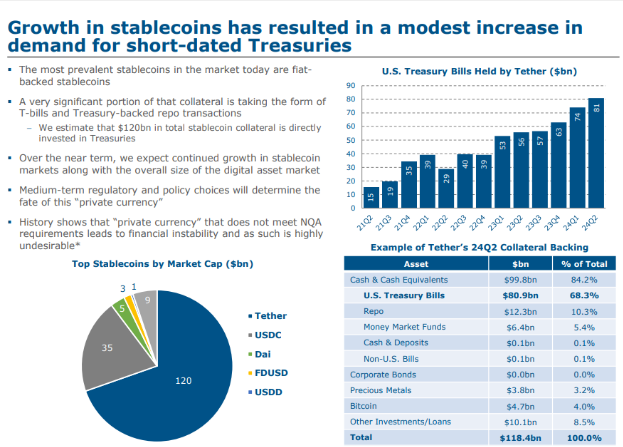

- Stablecoins are boosting demand for US Treasuries, with $120 billion invested within the collateral.

- Blockchain initiatives akin to JPMorgan's Onyx platform are revolutionizing Treasury operations and post-trade processes.

- Most central banks are exploring CBDC to handle new challenges within the digital asset panorama.

Digital belongings, particularly stablecoins and blockchain tasks, are reshaping the monetary panorama. A US Treasury report exhibits that digital currencies are rising demand for US Treasuries as traders and establishments discover blockchain's potential to extend the effectivity of economic transactions.

Stablecoins Enhance Demand for Treasuries

Stablecoins, digital currencies pegged to fiat belongings, play a key position in boosting demand for Treasuries. There may be an estimated $120 billion in stablecoins invested in Treasuries. Tether, the biggest stablecoin by market capitalization, allocates 68.3% of its 118.4 billion reserves to Treasury payments.

Different main stablecoins akin to USDC are additionally driving this demand. Stablecoins act as collateral in decentralized finance (DeFi) markets and supply liquidity in digital transactions. Greater than 80% of crypto transactions use stablecoins as one a part of the transaction.

Fiat-backed stablecoins are standard for his or her means to keep up a secure worth, making them appropriate collateral in monetary markets. This integration of stablecoins into the treasury market highlights their important position within the digital asset ecosystem. As well as, stablecoins are engaging in DeFi markets on account of their cash-like properties, making them engaging for lending and borrowing.

Blockchain tasks are modernizing cashier operations

As well as, each non-public and public tasks help the combination of blockchain into treasury operations. The SIFMA Multi-Asset Ledger Settlement Pilot Challenge and the DTCC Digital Asset Treasury Tokenization Challenge intention to enhance post-trade processes utilizing shared, immutable ledgers.

For instance, JPMorgan's Onyx platform, which launched in 2020, now permits real-time repo transactions by way of tokenized treasuries, serving to establishments handle collateral extra effectively.

Within the public sector, initiatives like Challenge Cedar – a collaboration between the New York Federal Reserve and the Financial Authority of Singapore – are utilizing distributed ledger expertise (DLT) to enhance cross-border funds.

The European Funding Financial institution additionally made information final yr when it issued £50bn value of digital bonds on a non-public blockchain. These tasks spotlight the rising curiosity in blockchain's potential to modernize monetary infrastructure.

Regulatory choices will probably be key in shaping the position and oversight of digital belongings. A 2021 BIS survey discovered that 86% of central banks are actively exploring the creation and implementation of central financial institution digital currencies (CBDCs) to handle these rising challenges.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shall not be responsible for any losses incurred because of the usage of mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.