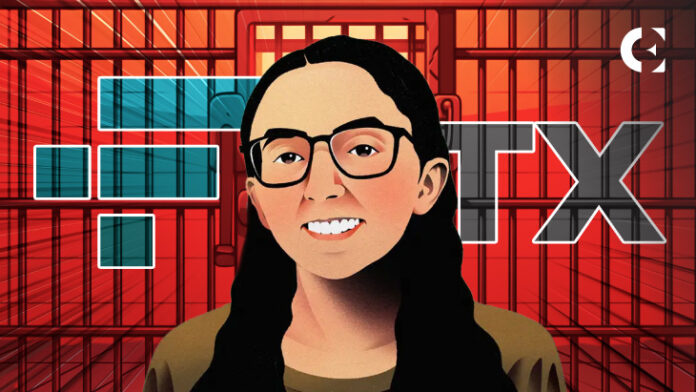

- Caroline Ellison was given a two-year sentence for complicity within the FTX scandal, which contrasts with Sam Bankman-Fried's 25-year time period.

- Ellison's testimony revealed how FTX misappropriated buyer funds and performed a key function within the investigation in opposition to Bankman-Fried.

- The FTX case raises questions on moral management and highlights the complexities of accountability within the cryptocurrency business.

Caroline Ellison, former CEO of Alameda Analysis, acquired two years in jail for her function within the FTX scandal. She appeared in federal court docket in Manhattan on Tuesday after pleading responsible to seven fees, together with wire fraud and cash laundering.

Ellison was a notable witness within the fraud trial of FTX founder Sam Bankman-Fried, who acquired 25 years in jail. Autism Capital stated Ellison's fees may have carried a most of 110 years in jail. Nonetheless, prosecutors really useful leniency due to her cooperation within the case.

Key function within the downfall of FTX

Ellison's testimony was crucial to uncovering fraudulent accounting practices between FTX and Alameda Analysis. This fraudulent exercise concerned the misuse of buyer funds for dangerous trades and private enrichment, which finally contributed to the downfall of FTX. Her testimony supplied key proof of the fraud orchestrated by Bankman-Fried and cemented the narrative of its leaders' function within the inventory market collapse.

Additionally learn: FTX founder defends himself: Claims of biased choose led to 25-year sentence

The case was presided over by Choose Lewis Kaplan, who handed down the sentences for each Ellison and Bankman-Fried. Whereas Bankman-Frieda's 25-year time period displays the seriousness of his actions, Ellison's lighter sentence acknowledges her cooperation with the prosecution. Prosecutors highlighted her exemplary cooperation, arguing that she performed a key function within the investigation.

Settlement and court docket testimony

In late 2022, Ellison pleaded responsible to seven fees as a part of a plea deal. The deal allowed her to testify in opposition to Bankman-Fried throughout his trial earlier this yr. Her courtroom revelations included an admission of fraud within the administration of Alameda Analysis. She additionally said that Bankman-Fried directed her to embezzle funds from FTX clients.

Her testimony, together with statements from different executives, positioned a lot of the blame for FTX's collapse on Bankman-Fried. The prosecution highlighted her substantial contribution to the case and emphasised her troublesome place as a cooperating witness. Prosecutors famous that the federal government couldn’t consider one other cooperating witness in current historical past who acquired extra consideration and harassment.

Public scrutiny and private struggles

Ellison confronted intense media scrutiny and public backlash after the autumn of FTX. Her relationship with Bankman-Fried grew to become the main target of tabloid tales highlighting her private issues. For instance, Bankman-Fried leaked her private information to the New York Occasions, which led to his bail being revoked.

Additionally learn: Caroline Ellison pleads for leniency in FTX case, cites cooperation in trial

These writings included her reflections on feeling unqualified for her function in Alameda. Additionally they revealed her emotional conflicts concerning her romantic relationship with Bankman-Fried. The courtroom drama surrounding the FTX case has sparked a wide-ranging debate about legal responsibility within the cryptocurrency sector.

Ellison's case reveals the complexity of management in failing organizations. Past the authorized ramifications, her story raises questions concerning the moral obligations of these in energy. Because the FTX saga continues to unfold, it stays to be seen how it will have an effect on the way forward for the crypto business.

Disclaimer: The knowledge supplied on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shall not be accountable for any losses incurred because of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.