- Bitcoin has soared greater than 9% previously week.

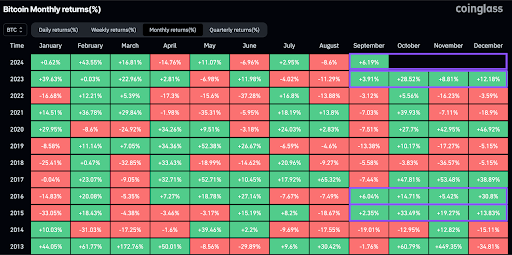

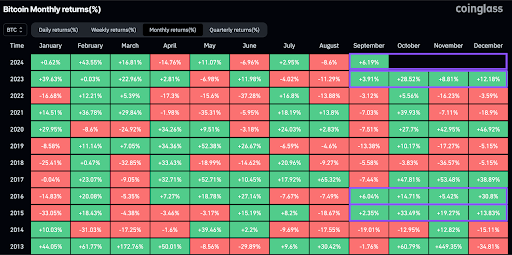

- At any time when September is inexperienced, the fourth quarter will probably be inexperienced, Lark Davis stated.

- Within the 2020 cycle, Bitcoin turned bullish 161 days after the halving.

Bitcoin's dominance within the digital asset market has remained unchallenged because it has risen massively for the reason that starting of September, regardless of a number of dips. The cryptocurrency is again on the $64,000 mark and short-term positive factors look promising. Analysts are even evaluating it to a bull run in 2020.

Lark Davis, a well known YouTuber and crypto analyst, tweeted: “At any time when September is inexperienced, This autumn was extraordinarily bullish for Bitcoin.” He included a chart exhibiting Bitcoin's previous efficiency in September and the fourth quarter, suggesting that good occasions are forward.

And in one other submit, X Rekt Capital identified that 161 days have handed for the reason that Bitcoin halving. He reminded his followers that in the course of the 2020 bull run, BTC noticed a large rally 161 days after the halving, reaching an all-time excessive of $69,000 in November 2021.

Additionally Learn: Bitcoin Authorities Rankings: USA Prime Record, Bhutan and El Salvador Lively

Within the present cycle, bitcoin hit an all-time excessive of $73,750 in March following the approval of spot bitcoin exchange-traded funds (ETFs) in america in January. In line with information from CoinMarketCap, BTC is buying and selling at $64,022.38, up 1.44% over the previous 24 hours, up 9.52% over the previous week, and up 0.04% over the previous 30 days.

Bitcoin value evaluation factors to additional positive factors

Bitcoin value evaluation reveals large bullish potential for the cryptocurrency amid a surging market. If the main digital asset manages to carry above $64,000, there’s a robust risk of upper highs within the close to future.

The chart under reveals that Bitcoin has fashioned seven consecutive bullish candles and shopping for volumes are growing. This implies that the rally may proceed within the brief time period.

The Relative Energy Index (RSI) is at 64.25, which signifies that bulls are in general management of Bitcoin's motion, and the gradient of the road means that greater costs are attainable.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any type. Coin Version shall not be accountable for any losses incurred on account of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.