Regardless of some mid-week turbulence, the worth of Bitcoin (BTC) elevated to approxhave been dropping positively for the previous week, with a complete worth acquire of 4.07% in response to information from CoinMarketCap. This constructive worth efficiency allowed BTC to keep up its upward trajectory from the earlier week when it crossed the $60,000 worth barrier. Nevertheless, amid these worth good points, it stays extremely unsure whether or not the cryptocurrency market chief has now entered a bullish pattern.

Associated Studying: Bitcoin Bull Run Begins: Skilled Factors To Huge Development Potential In Coming Months

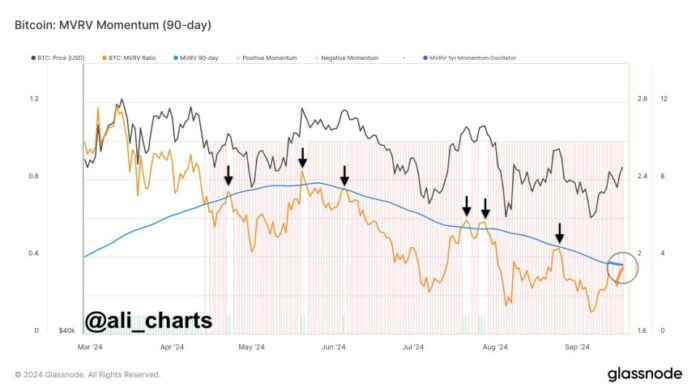

Bitcoin MVRV Motion Key to Bull Run, Analyst Says

On Friday, common crypto analyst Ali Martinez shared a market scenario that might sign BTC's return to a bullish part. Over the previous two weeks, the main cryptocurrency has gained greater than 23%, transferring from round $52,800 to a peak worth of $64,041.

Martinez does, nonetheless, anticipate that Bitcoin's Market Worth to Realized Worth (MVRV) ratio wants to shut above its 90-day transferring common to determine a bullish pattern after weeks of sideways motion in July and August. Typically, the MVRV ratio is used to evaluate the pattern of the Bitcoin market, with a excessive ratio indicating potential overvaluation of the asset and a low ratio signaling undervaluation.

When Bitcoin's MVRV crosses its 90-day transferring common, i.e. the typical of the MVRV over that interval, it signifies that the asset is in a correction or bearish part, with traders probably holding unrealized losses, which might quickly set off damaging sentiment. Conversely, when MVRV strikes above its 90-day transferring common, it indicators bullish momentum as Bitcoin's market worth rises above historic averages.

Ali Martinez hypothesized that the second situation should happen to stamp out Bitcoin's bullish transition regardless of the market's latest good points. If this state of affairs unfolds, BTC might climb as much as $68,000-$70,000, the place its subsequent main resistance stage lies. In that case, the main cryptocurrency might probably see an general constructive efficiency in September, a month identified for bearish returns.

New $2 Billion BTC Futures Contract Dangers Potential Lengthy Compression

In different information, Bitcoin merchants have opened roughly $2 billion in futures contracts up to now 48 hours following the latest surge within the asset's worth. Whereas this growth represents excessive market curiosity in Bitcoin, it additionally represents a big improve in leveraged positions. Ali Martinez states that this case presents a threat of long-term compression, i.e. if the worth of BTC falls, the positions of those merchants could also be violently liquidated, resulting in downward strain on the worth of Bitcoin.

On the time of writing, BTC continues to commerce at $62,875 with a lack of 1.59% over the past day. In the meantime, the asset's each day buying and selling quantity fell by 16.75% to $36.4 billion.

Featured picture from The Motley Idiot, chart from Tradingview