The US Securities and Alternate Fee (SEC) has filed an amended criticism towards Binance within the District of Columbia, introducing procedural updates and authorized amendments to the unique submitting.

The modification, accepted this morning, features a Federal Rule of Civil Process 15(a)(2) movement, accompanied by a memorandum explaining the explanations for the adjustments, a proposed amended criticism and a redline model highlighting the adjustments.

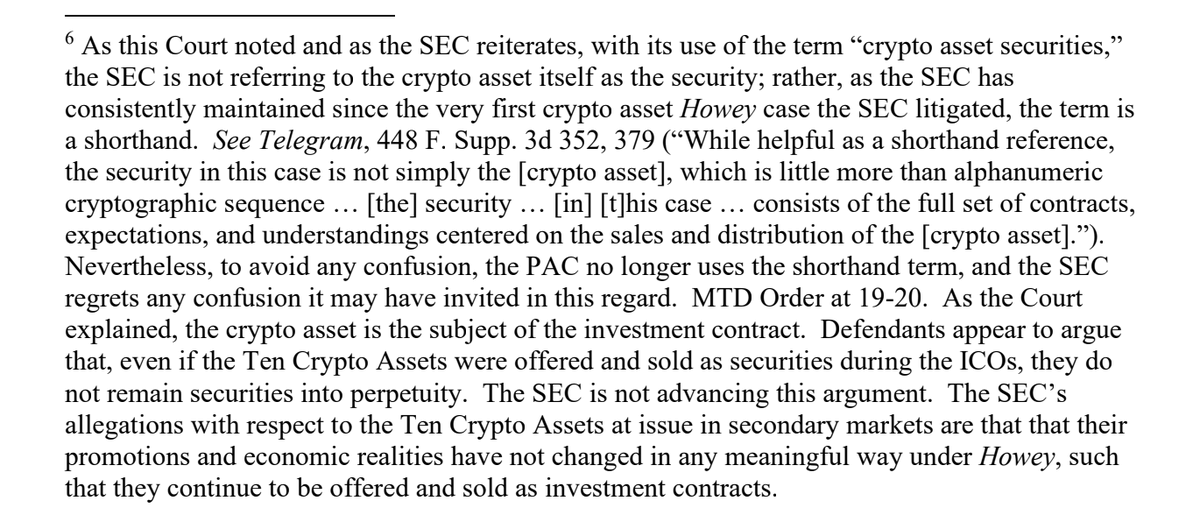

Paul Grewal, Coinbase's chief authorized officer, commented on the SEC's amended criticism by way of social media. “The SEC regrets any confusion it might have attributable to falsely and repeatedly stating that the tokens themselves are securities,” he famous, highlighting footnote 6 of the amended criticism. He questioned the SEC's longstanding place, stating,

“The SEC completely 'maintains' that tokens themselves are securities, evident from their lengthy report of regulatory enforcement campaigns. Why mislead the Courtroom?”

Grewal shared an excerpt from the criticism that clearly states the SEC admits regret.

Grewal additionally addressed the SEC's strategy to Ethereum (ETH) transactions, noting the company's lack of readability on how ETH transactions have modified considerably in comparison with different digital property it tracks.

famous

“ETH transactions in some way modified in a significant approach, in contrast to the Ten Crypto Property, to keep away from the clutches of the company. As? That's clearly for the SEC and the remainder of us to know, simply to know if and after we get sued.”

In line with the amended criticism, the submitting refers to different paperwork, together with an order denying the defendants' movement to dismiss in a associated case, SEC v. Payward, Inc. (Kraken). Deadlines have been set, with Binance and its co-defendants having till October 11 to reply both by opposing the SEC's movement or submitting a discover of consent.

Authorized analysts recommend the SEC's modification could possibly be an try and bolster its case amid criticism over regulatory readability. The company faces ongoing scrutiny from trade individuals who say its enforcement actions lack clear pointers for what constitutes safety in cryptocurrencies.

Binance is beneath regulatory stress from the SEC, which claims the platform operated unregistered inventory exchanges and misled buyers. The change has persistently denied the allegations and asserts its dedication to compliance and cooperation with regulators.

The deadline for Binance and its co-defendants to answer the SEC's amended criticism units the stage for a significant authorized showdown forward of the US election, the place cryptocurrency regulation is changing into more and more vital.

The trade's demand for regulatory readability continues to develop, with many calling for definitive steering reasonably than enforcement as the first technique of regulation.