In line with the most recent CoinShares report, digital asset funding merchandise noticed important outflows totaling $726 million, matching the best outflows recorded earlier this yr in March.

James Butterfill, head of analysis at CoinShares, attributed the unfavorable sentiment to stronger-than-expected macroeconomic information from the earlier week. This raised the probability of a 25 foundation level rate of interest hike by the US Federal Reserve.

added:

“Day by day outflows slowed later within the week as employment information fell in need of expectations, leaving market views on a possible 50 foundation level price lower extensively combined. Markets now await Tuesday's Client Worth Index (CP|) inflation report, with a 50bp lower extra possible if inflation is available in beneath expectations.

US, bitcoin lead drain

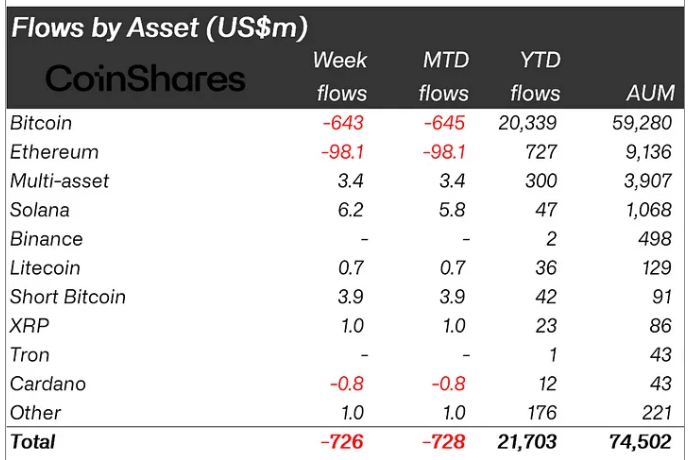

Bitcoin led the outflows, shedding $643 million, bringing its month-to-month outflow to $645 million. Nonetheless, brief BTC funds noticed a smaller influx of $3.9 million.

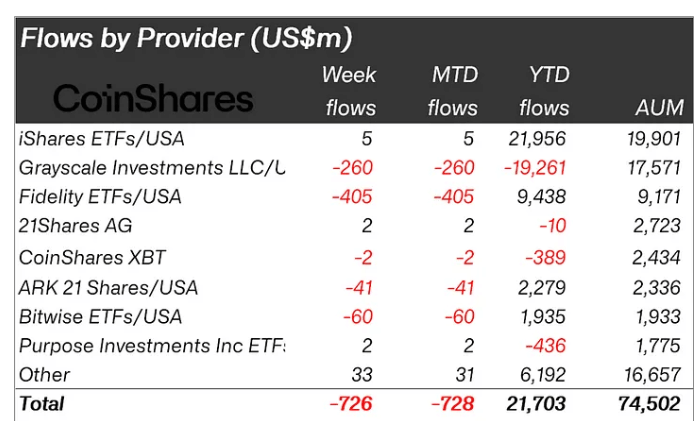

In the meantime, US bitcoin exchange-traded funds (ETFs) noticed an eight-day streak of outflows, inflicting a web outflow of $721 million within the nation. Most of that got here from Constancy's FBTC fund, which noticed $405 million in outflows final week.

It was adopted by Grayscale's GBTC, which noticed an outflow of $280 million. Bitwise ETFs completed the highest three final week with losses of round $60 million.

Canada additionally noticed an outflow of $28 million. In distinction, Europe noticed extra constructive sentiment, with Germany and Switzerland seeing inflows of $16.3 million and $3.2 million respectively.

Altcoins have had combined fortunes.

Ethereum-based funding merchandise noticed a web outflow of $98 million final week.

This was primarily because of Grayscale's transferred ETHE fund, which misplaced $111 million in the course of the interval. This meant that minimal inflows into different spot Ethereum ETF merchandise couldn’t offset important outflows, additional supporting recommendations that there is no such thing as a demand for these funding merchandise.

Nonetheless, Solana-based funding merchandise noticed web inflows of $6.2 million, the most important amongst digital asset merchandise.

Different digital belongings resembling Cardano noticed an outflow of round $800,000 regardless of finishing the primary section of its extremely anticipated Chang Exhausting Fork. As compared, Litecoin and XRP noticed cumulative inflows of $1.7 million.