- Vitalik Buterin revealed that 36.5% of the Ethereum Basis's 2023 funds was allotted to new foundations.

- Buterin's annual wage is about at SGD 182,000, roughly $134,000, which ensures transparency in Ethereum's monetary operations.

- The Ethereum market is displaying blended indicators with a 4.94% drop in value and a 62.47% improve in choices buying and selling quantity.

Ethereum (ETH) co-founder Vitalik Buterin has shared new details about the Ethereum Basis's bills in 2023 and his personal wage. Buterin, recognized for influencing the market along with his contributions, offered an in depth breakdown of the inspiration's bills.

In a publish on his X account, Buterin outlined the first spending classes. The biggest half; 36.5% was allotted to “New Foundations”, together with organizations such because the Nomic Basis, The DRC, L2Beat and 0xPARC. As well as, investments have been channeled into tier-1 analysis and improvement, which accounted for twenty-four.9% of the funds, and group improvement, which acquired 12.7%.

Buterin additionally disclosed his annual wage set at SGD 182,000, equal to roughly $134,000. This disclosure presents perception into the monetary operations of the Ethereum Basis.

The crypto market reacted to Buterin's publish, and Ethereum is at present buying and selling at $2,589.24 with a 24-hour buying and selling quantity of $14.09 billion. The worth has fallen by 4.94% within the final 24 hours, bringing Ethereum's market cap to $311.48 billion. Ethereum's circulating provide is 120.30 million ETH cash.

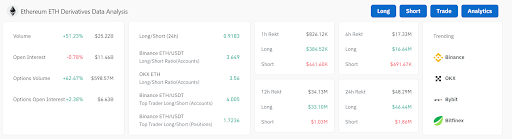

Ethereum derivatives buying and selling information additionally confirmed a rise in exercise. Buying and selling quantity elevated 51.23% to $25.22 billion, though open curiosity noticed a slight decline. Choices buying and selling noticed a big quantity improve of 62.47%. Moreover, lengthy/quick ratios mirror usually bullish sentiment, significantly on Binance and OKX, the place lengthy positions dominate.

Nevertheless, the general 24-hour lengthy/quick ratio stands at 0.9183, indicating a slight choice for brief positions throughout the market. Binance's prime merchants present a powerful lengthy bias, indicating confidence in Ethereum's potential regardless of latest value declines.

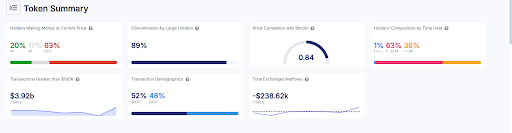

Moreover, Ethereum's present market state presents blended indicators. ETH is buying and selling at $2,588.92, down 2.16% within the final 24 hours, with a market cap of $326.69 billion. Presently, solely 20% of holders are worthwhile, whereas 63% are at a loss. Massive holders management 89% of the availability, which suggests excessive centralization. Moreover, ETH exhibits a powerful correlation (0.84) with Bitcoin value actions.

Regardless of short-term bearish developments, the information suggests continued curiosity and potential for Ethereum within the broader market. Destructive trade internet movement within the quantity of 238.62 thousand. Final week's USD might point out accumulation. These metrics would subsequently counsel that Ethereum stays a key participant in a crypto market whose future outlook is intently tied to broader market situations.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shall not be answerable for any losses incurred on account of using mentioned content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.