Analyzing bitcoin and fiat buying and selling pairs on centralized exchanges usually reveals efficiency variations that stay invisible when specializing in international or common costs. It exhibits how liquidity, geopolitical and financial issues and market sentiment have an effect on efficiency.

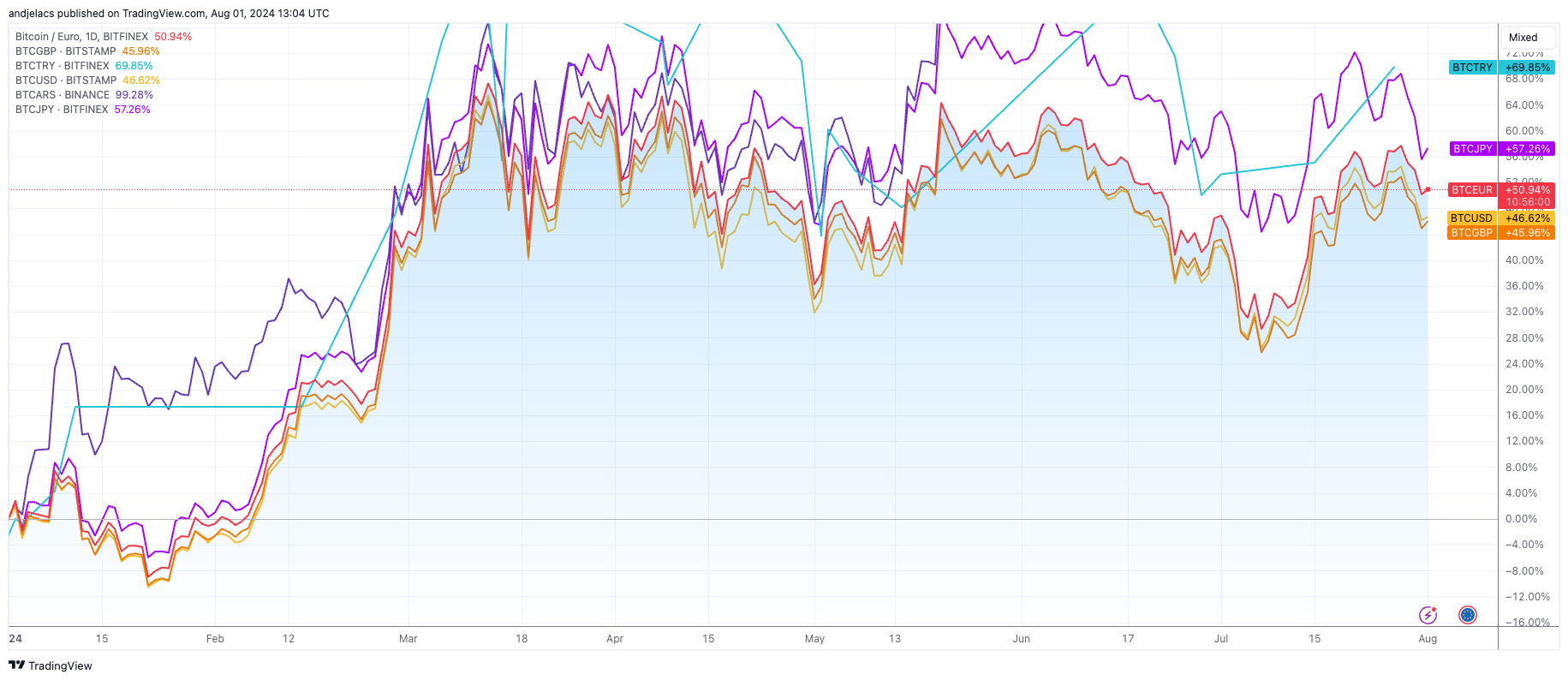

Trying on the year-to-date (YTD) efficiency of the dominant fiat pairs, we are able to see that BTCARS has seen a powerful 98.27% improve. BTCTRY gained 69.85%, BTCJPY rose 55.01%, BTCEUR rose 49.85%, BTCUSD rose 45.62% and BTCGBP rose 45.07%.

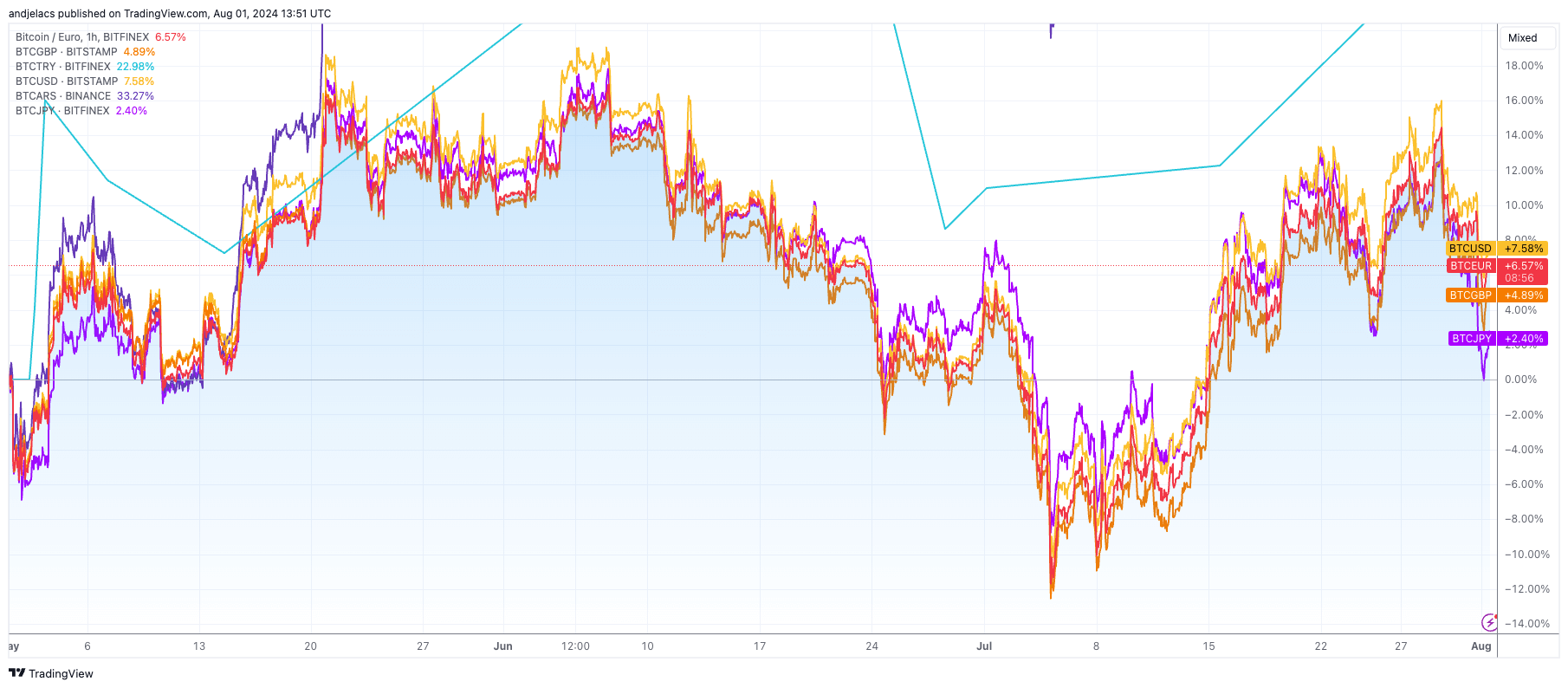

In distinction, the three-month efficiency exhibits BTCARS main with a 19.64% achieve, whereas BTCEUR, BTCUSD, BTCGBP, BTCJPY and BTCTRY all posted unfavourable returns starting from -1.16% to -6.50%.

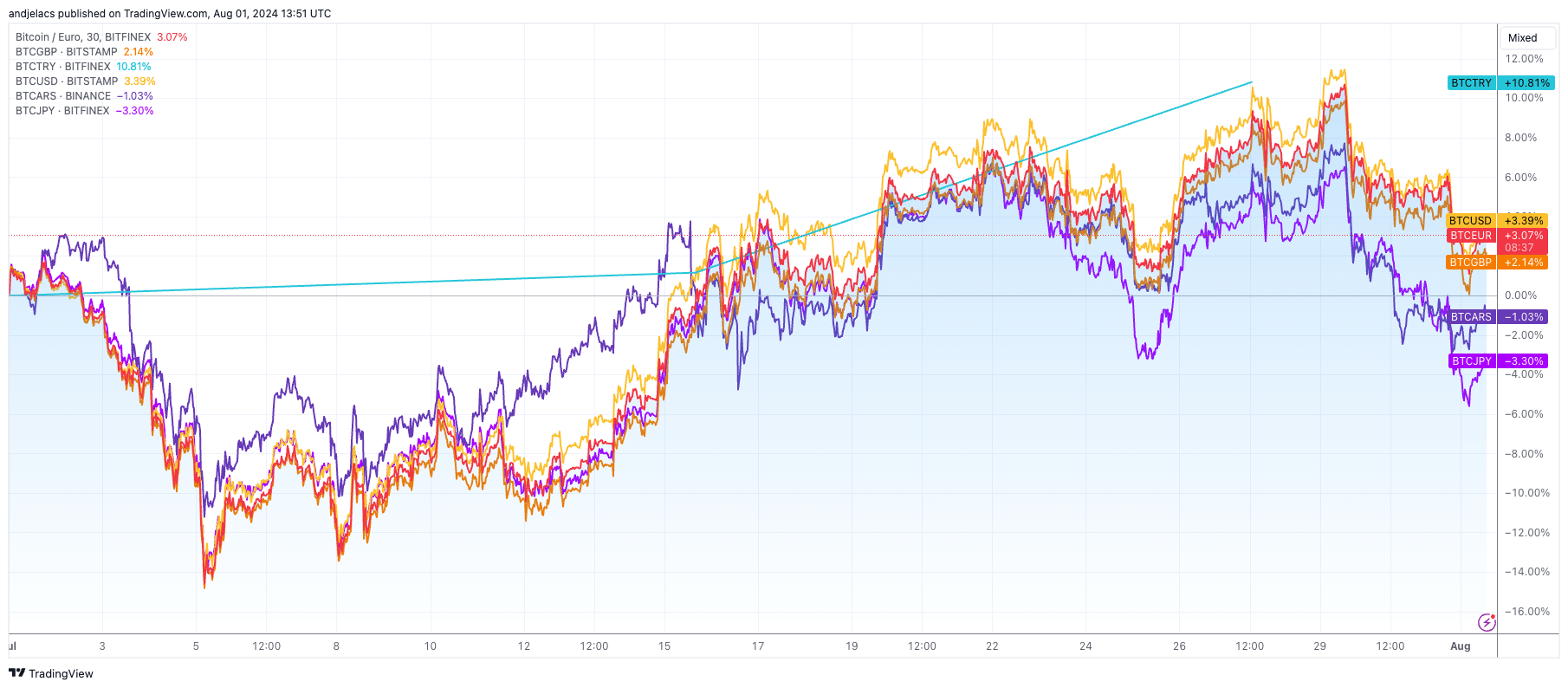

One-month efficiency presents a blended image, with BTCTRY up 10.81%, BTCUSD up 2.97%, BTCEUR up 2.72% and BTCGBP up 2.03%, whereas BTCARS and BTCJPY are down -0.85% and -3.89%, or

Bitcoin's glorious efficiency in opposition to the Argentine peso, particularly for the reason that starting of the 12 months, could be attributed to the nation's sturdy inflation. With inflation charges exceeding 100% per 12 months, the speedy devaluation of the Argentine peso has brought about buyers to hunt refuge in Bitcoin.

This conduct is per historic tendencies the place residents of nations experiencing hyperinflation or financial instability flip to cryptocurrencies as a hedge in opposition to the depreciation of their native forex. Whereas newly elected Argentine President Javier Milea's financial and political insurance policies have slowed inflation, demand for Bitcoin stays sturdy.

BTCTRY's equally sturdy year-to-date efficiency comes from Turkey's financial woes. Turkey is combating excessive inflation and up to date studies put the inflation charge at over 75%. The depreciation of the Turkish lira has led to elevated adoption of Bitcoin amongst Turkish buyers seeking to protect their wealth.

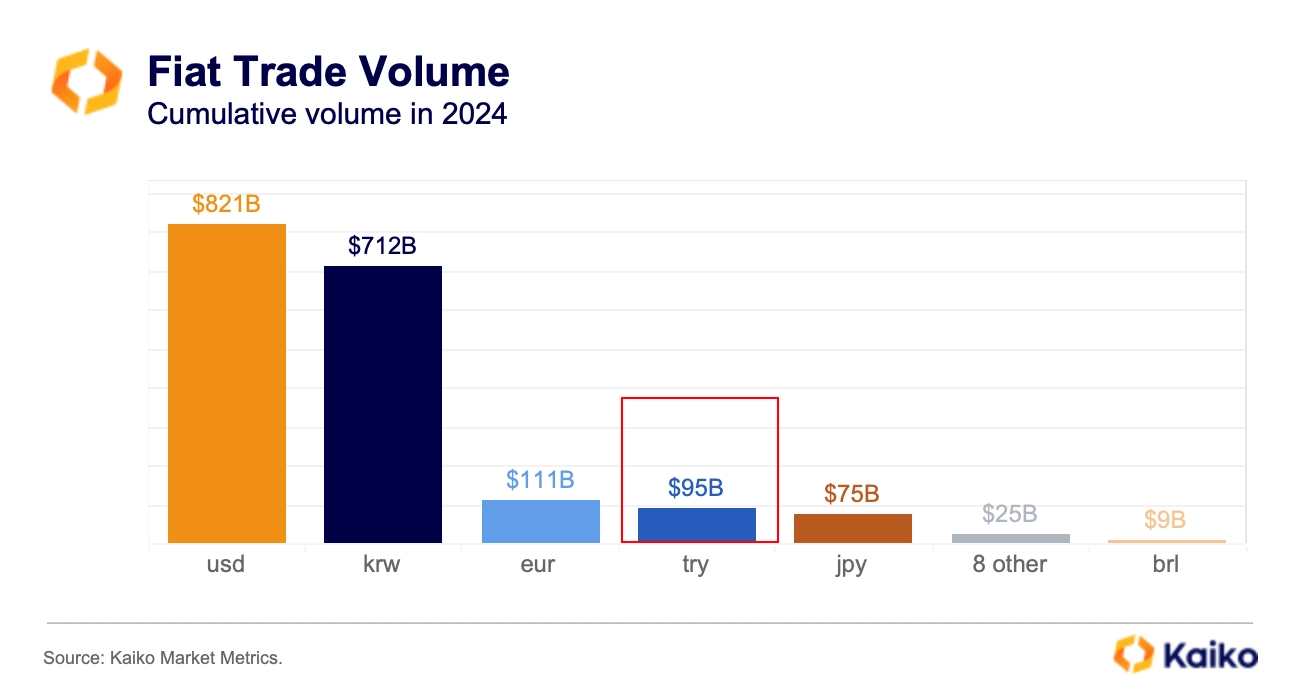

This development is additional fueled by the truth that Turkey has one of many highest cryptocurrency adoption charges on this planet. Kaiko information confirmed Turkish lira buying and selling quantity exceeded $10 billion for eight consecutive months, with cumulative lira quantity reaching $95 billion throughout seven exchanges.

The yen's weak point in opposition to the greenback, pushed by the dovish stance of the Financial institution of Japan, weighed on the BTCJPY pair. Japan's intervention within the forex market to stabilize the yen additionally contributed to the fluctuations seen within the worth of bitcoin in opposition to the yen. The unfavourable 3M and 1M efficiency signifies short-term volatility and the impression of those interventions.

The euro's, US greenback's and British pound's modest year-to-date features and blended short-term efficiency could also be associated to comparatively steady financial circumstances and strong monetary infrastructure within the eurozone, US and UK.

The latest power of the US greenback has affected the BTCUSD pair, resulting in its subdued efficiency within the shorter time period. The euro and pound appear to have skilled a bit extra strain as a result of financial challenges and central financial institution insurance policies, resulting in their outperformance in opposition to the greenback.

Liquidity additionally performs an important position within the efficiency of fiat buying and selling pairs. Extremely liquid markets like BTCUSD and BTCEUR have a tendency to point out decrease volatility and extra steady costs. Excessive liquidity makes it potential to hold out bigger transactions with out a vital impression in the marketplace worth.

Conversely, pairs with decrease liquidity, equivalent to BTCARS, are extra vulnerable to massive worth swings and larger volatility. This increased volatility can result in greater features in periods of excessive demand, as seen within the efficiency of BTCARS and BTCTRY for the reason that starting of the 12 months.

The put up Bitcoin fiat pair efficiency highlights financial and political challenges appeared first on fromcrypto.