German authorities just lately liquidated about $3 billion value of bitcoins. From June 19 to July 12, the German authorities offered 49,858 BTC tokens for roughly 2.6 billion euros, or $2.9 billion.

The sale, thought of an “emergency” measure, was linked to the continuing legal prosecution. However politicians and enterprise managers alike expressed sturdy disapproval and disapproval of the large-scale liquidation.

The federal government promised that the sale can be executed in a approach that supported the market, but through the sale interval, the worth of bitcoin fell by greater than 22%, from $65,695 to $53,717.

Regardless of the supposed prudence, many have begun to query the true market impression of such a big selloff in mild of the latest sharp decline.

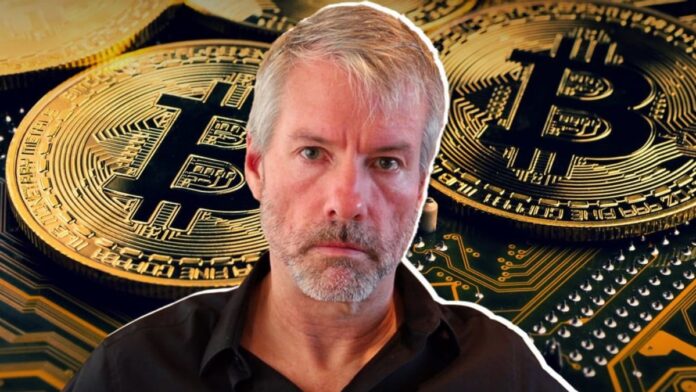

Michael Saylor provides his two cents

MicroStrategy chairman and well-known Bitcoin supporter Michael Saylor is among the many most outspoken opponents of the German authorities's determination.

Saylor expressed his disgust on social media by posting in German: “Till you run out of bitcoins, it's not an emergency.” His considerably mocking comment demonstrated his overwhelming perception in bitcoin's potential by suggesting that the cryptocurrency's depletion is itself pressing.

Es ist kein Notfall, bis du kein #Bitcoin mehr hast

— Michael Saylor

(@saylor) July 17, 2024

Michael Saylor directed MicroStrategy to persistently spend money on Bitcoin in 2020. With an unrealized revenue of $6.2 billion, the corporate spent $8.3 billion on Bitcoin. Saylor is devoted to the world's hottest digital asset and believes that at present's monetary methods should combine it.

The lawmaker shares Saylor's view on bitcoin

German MP Joana Cotar joined Michael Saylor in her refrain of criticism. Cotar stated bitcoin must be stored available as a reserve and regretted the federal government's determination to promote its holdings.

She referred to as the sale pointless, particularly at a time when Wall Avenue titans and different monetary establishments are starting to acknowledge bitcoin.

BTC market cap presently at $1.2 trillion. Chart: TradingView.com

The liquidation in Germany provoked considerably extra opposition than in different international locations similar to El Salvador. Bitcoin grew to become authorized forex for El Salvador in 2021, and the nation now has 5,508 bitcoins value roughly $300 million.

Appearing proactively, the Central American nation is treating bitcoin as a standard type of cash and introducing rules that arrange personal funding banks and different digital belongings.

Salvadoran legal guidelines reveal that an increasing number of nations imagine that Bitcoin could be a worthwhile device for their very own economies.

The truth that a nation welcomes Bitcoin is sort of completely different from Germany's determination to promote its reserves. This opens up a dialogue in regards to the impression of digital currencies on nationwide economies.

In the meantime, Saylor's issues a couple of large German crackdown on cryptocurrencies will likely be one thing that bitcoin lovers will likely be watching intently within the coming days and weeks.

Featured picture from VOI, chart from TradingView