Bitcoin fell beneath $64,000, its lowest stage since mid-Could, as a consequence of elevated promoting stress available in the market.

BTC is generally buying and selling down or sideways after crossing the $70,000 mark earlier within the month. Since then, the flagship asset has misplaced greater than 10% of its positive factors throughout that interval.

Why is BTC falling?

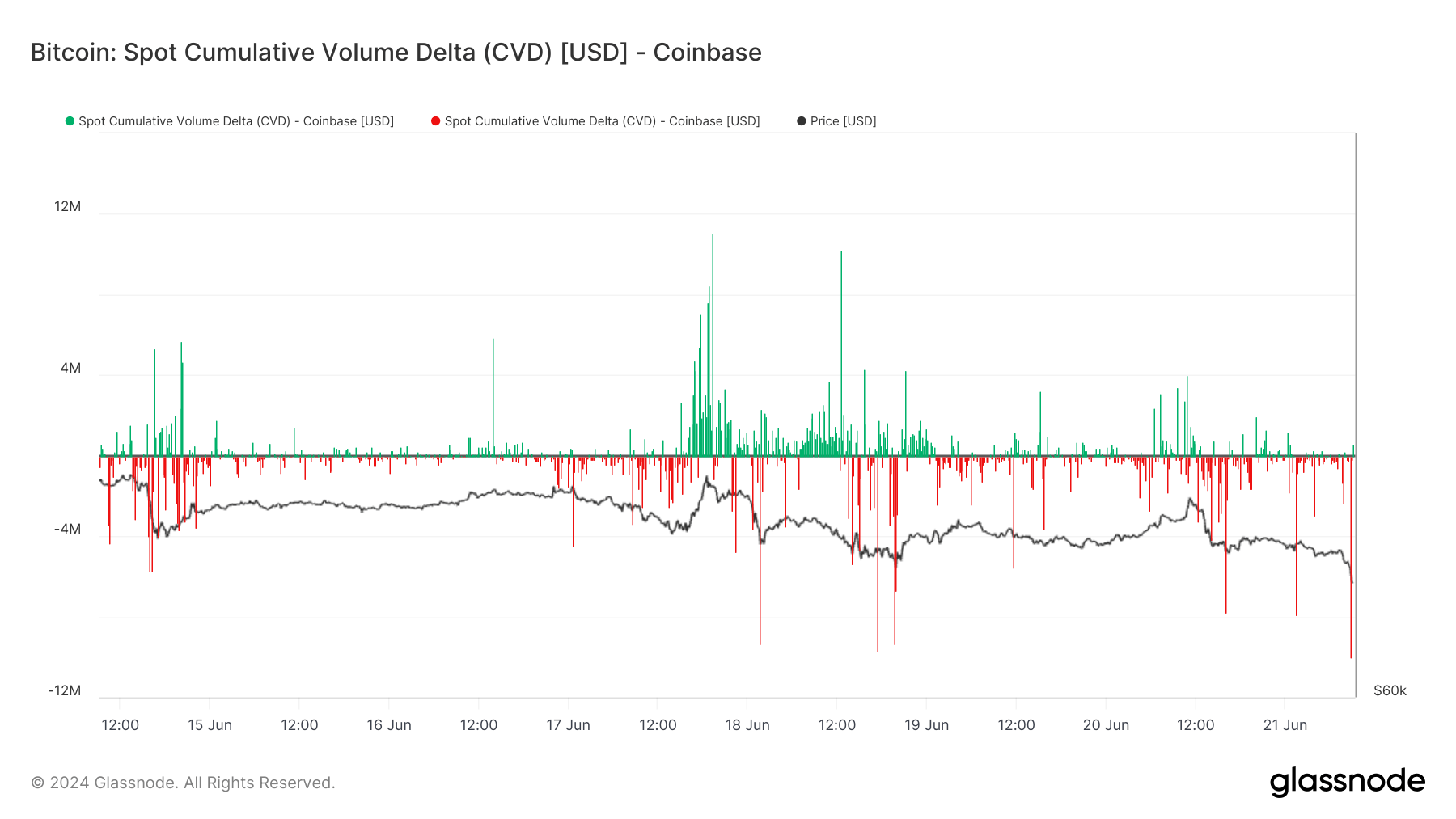

Chain information reveals that some latest promoting stress has come from Coinbase, the biggest US-based crypto trade. Glassnode information exhibits the platform noticed $10 million in spot gross sales, the best quantity throughout a 10-minute window in per week.

Contributing to the present promoting stress is the German authorities, which moved $600 million in BTC on June 19, with $195 million despatched to 4 trade addresses, together with Kraken, Bitstamp, and Coinbase.

Market specialists attribute the present BTC value weak point to elevated outflows from US spot bitcoin exchange-traded funds (ETFs). Whereas curiosity in these ETFs surged after their approval in January, resulting in inflows of greater than $53 billion, there have been web outflows of greater than $900 million final week.

Moreover, BTC miners have been unloading their holdings as a result of monetary stress introduced on by the latest halving occasion. Bitcoin analyst Willy Woo mentioned that the value of BTC will solely recuperate “when the weak miners die and the hash fee recovers”.

$20 million liquidation in 1 hour

Information from Coinglass reveals that the market decline worn out roughly $20 million in crypto positions within the final hour, for a complete of $150 million up to now 24 hours.

A better have a look at the liquidations exhibits that the heaviest losses have been confronted by lengthy merchants betting on value will increase, dropping $106 million. In distinction, quick merchants with a extra bearish outlook have been liquidated for $44 million.

Bitcoin merchants noticed the most important losses, totaling $42 million — $26 million from lengthy positions and $16 million from quick positions. Ethereum merchants adopted intently behind, with liquidations reaching round $28 million.

Essentially the most important single liquidation happened on Bybit and concerned an $8.09 million BTCUSD transaction.