MicroStrategy purchased almost 12,000 BTC for $786 million, in keeping with a June 20 submitting with the US Securities and Change Fee (SEC).

Following the information, the corporate's shares rose 3% in premarket buying and selling to $1,507, in keeping with Google Finance information.

Shopping for Bitcoins

The submitting said:

“MicroStrategy acquired roughly 11,931 Bitcoins for about $786.0 million in money, utilizing proceeds from the providing and extra money (as outlined in our Quarterly Report on Type 10-Q for the three months ended March 31, 2024), at a median value of roughly 65,883 {dollars}. per bitcoin, together with charges and bills.”

With this newest acquisition, the corporate's Bitcoin holdings rose to 226,631 BTC. These have been acquired for a complete buy value of round $8.3 billion, a median of about $36,798 per BTC. Primarily based on present costs of $65,990, the present market worth of those shares is over $15 billion.

The corporate just lately accomplished an $800 million debt providing with a 2.25% coupon and a 35% conversion premium. For the reason that starting of the 12 months, this technique has helped the corporate increase greater than $2 billion in bitcoin purchases.

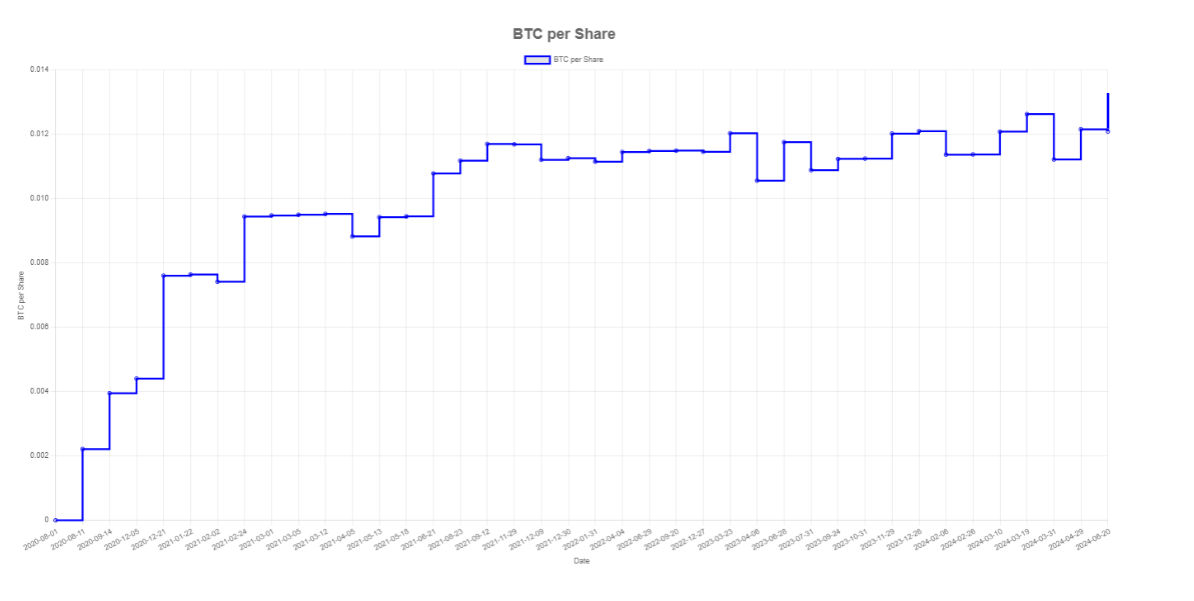

Regardless of issuing extra shares, which normally lowers the worth of shares, fromcrypto Perception reported that the worth of bitcoin per share of the corporate elevated. This improve implies that every share now represents a better worth of Bitcoin, benefiting shareholders.

Bitcoin holdings per share of MicroStrategy elevated to 0.013163 BTC, with 17,194,000 shares excellent and a complete of 226,331 BTC held.

BTC to $1 million

In the meantime, Bernstein analysts have considerably raised their bitcoin value projections, predicting that the flagship digital asset will attain $1 million by 2033 and $200,000 by the top of 2025.

This bullish outlook relies on rising demand for prime cryptocurrencies and restricted provide. Analysts identified that newly launched spot bitcoin ETFs and a number of other establishments have began incorporating BTC into their coffers.

In addition they famous that the digital asset may acquire approval in main bureaus and main non-public banking platforms by the top of the 12 months, prompting institutional-based buying and selling methods to additional drive its adoption.