- The value of uniswap hit a excessive of $10.99 on Could twenty fifth and rose by greater than 20% in 24 hours.

- UNI was acquired by whale exercise, the evolution of the Ethereum ecosystem and Uniswap Labs' response to the SEC Wells Discover.

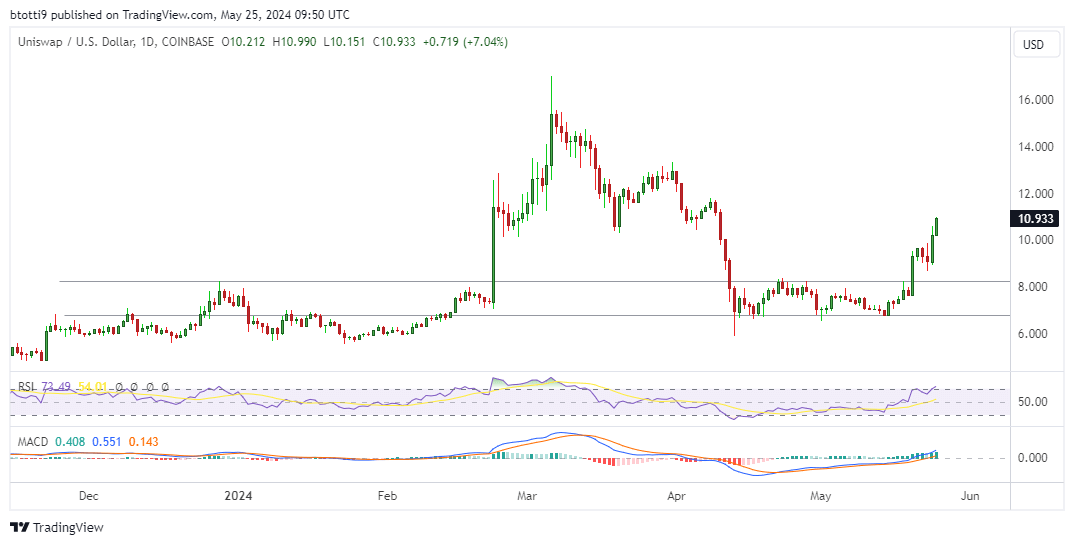

- The technical image additionally suggests a breakout that would push the value of UNI to $15.40 and in the direction of $2.

The uniswap worth jumped greater than 20% in 24 hours to commerce at $10.99, the best stage since early April.

The bullish outlook means that elevated shopping for strain may push UNI in the direction of the $15.40 highs reached in March.

Uniswap worth and ETH ecosystem

UNI is the native token of the main DEX platform, most likely top-of-the-line beta performs round Ethereum ETF approval.

On Friday, the value of Uniswap defied a market-wide consolidation, with the value of Ethereum (ETH) hovering above $3,700. As most altcoins seemed set to bounce off key assist ranges, UNI worth rose greater than 20% to succeed in a multi-week excessive of $10.95.

This comes because the whales more and more pull UNI from the inventory exchanges. In line with chain particulars shared by Lookonchain on X, one such whale withdrew $1.96 million in UNI from Binance when the value rose.

Uniswap's upward momentum additionally strengthened amid the ERC-7683 reveal. This new token commonplace is a collaboration between Uniswap Labs and Throughout Protocol and goals to streamline cross-chain buying and selling via a “unified framework for cross-chain intents methods”.

UNI surged after Uniswap's response to the SEC

The break of the vital $10 barrier additionally got here amid rising bullish sentiment round Uniswap's regulatory outlook.

Earlier this week, Uniswap Labs reiterated its readiness to battle a possible SEC lawsuit following Wells' latest announcement.

In line with Uniswap, the SEC is “improper” in its declare that the DEX platform is an unregistered inventory change and broker-dealer. The declare that UNI is a safety can also be false as a result of the SEC's theories surrounding it are “weak,” Uniswap wrote in a response to the regulator.

Uniswap worth chart

Uniswap's rise over the previous 24 hours is witnessing a breakout of UNI's consolidation section, which had costs capped beneath the $8 stage.

Elevated whale exercise and present projections for the ETH ecosystem favor UNI bulls.

The technical image additionally helps an upward continuation. On this case, the RSI and MACD indicators on the each day chart point out that the bulls are in management.

If this outlook holds, UNI worth may observe key resistance ranges at $12.96 and $15.40. An vital short-term goal lies at $2