Bitcoin continues to be holding above $60,000, however current miners' actions may disrupt this stability very quickly. The current halving decreased the block reward from 6.25 BTC to three.125 BTC, which means that miners at the moment are paid half as a lot for verifying transactions and mining new blocks. As famous in a current Kaiko report, miners' incomes have fallen for the reason that halving, and miners are beginning to really feel the stress.

Bitcoin beneath elevated stress

Bitcoin miners rely closely on two sources of revenue to proceed working: the mining reward and transaction charges. The Bitcoin market is cyclical, and every halving has traditionally led to elevated promoting stress from miners. Knowledge present that the current halving in April resulted in ca bitcoin hash fee drop mining profitability is now at its lowest in three years.

For miners with excessive working prices, this drastic discount in mining wages means they’ve to seek out different methods to generate revenue and finance their companies. For a lot of, the one possibility is to promote a few of the BTC they maintain. Marathon Digital and Riot Platforms, two of the biggest Bitcoin miners, at the moment maintain over $1.6 billion value of BTC between them, in response to findings.

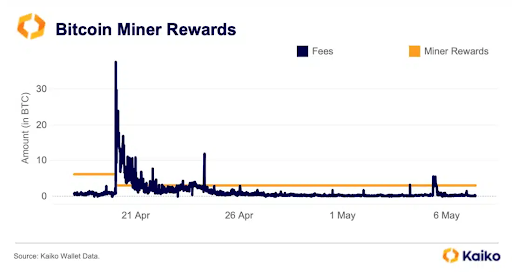

Apparently, the increment Bitcoin Community Charges earlier than and after the halving principally offset working prices and compelled the necessity to promote. In response to Kaiko, community charges accounted for 16% of the BTC earned by Marathon Digital in April, a leap from 4.5% in March.

Nonetheless, current buying and selling exercise and a drop in quantity over the previous few days implies that community price revenue is falling and the probability of miners promoting their holdings is rising.

What's subsequent for BTC?

On the time of writing, Bitcoin is buying and selling at $61,888 and is down 1.20% within the final 24 hours. The subsequent three to 6 months will likely be essential in figuring out how a lot the halving and miner promoting will have an effect on the value of Bitcoin. If demand stays sturdy and most main miners can climate the decline in income with out promoting an excessive amount of of their holdings, the value may stay steady and even start to rise.

Fortuitously, there are nonetheless loads of them catalysts of value jumps which may offset the upcoming sell-off from miners. So Bitcoin has a fantastic probability defend the $60,000 value stage. An instance is the mainstream adoption of BTC by means of the Spot Bitcoin ETF. Some Bitcoin whales additionally use value consolidation to replenish their holdings. Chain knowledge reveals that short-term whale holders is now piling up round 200,000 BTC per week.

Featured picture from Cash, chart from Tradingview.com