- Algorand holders face vital losses, a staggering 89% underwater.

- Solely 8% of traders in ALGO are at present in revenue on the worth of $0.1818.

- Gary Gensler beforehand praised Algorand, serving to the asset attain $3.56 ATH.

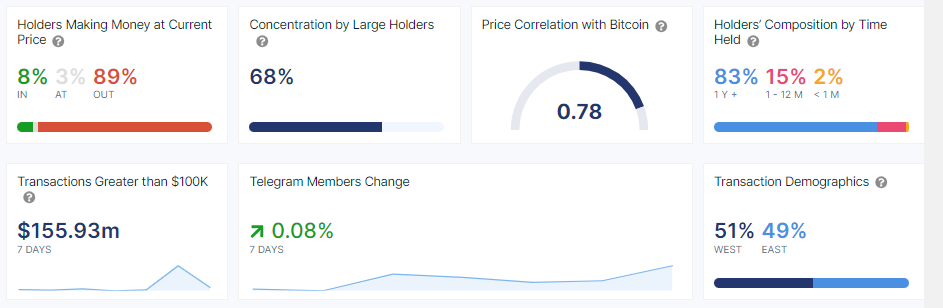

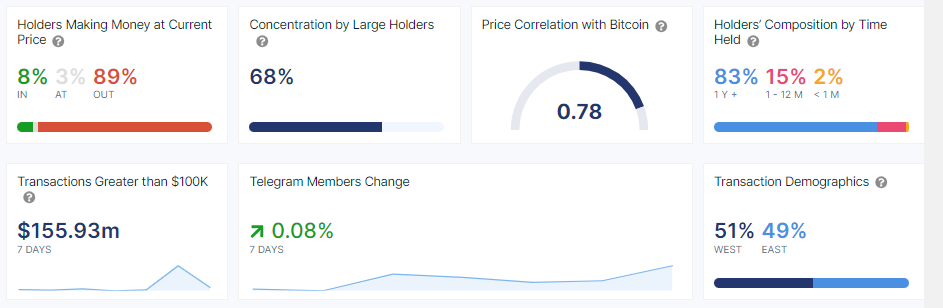

Because the crypto market experiences a downturn, crypto traders are feeling the warmth, particularly those that personal Algorand (ALGO), Gary Gensler's lauded challenge. Information from the analytics platform IntoTheBlock exhibits that 89% of ALGO holders are at a loss. These traders are “out of the cash”, that means that the overwhelming majority of ALGO traders are holding property under the worth at which they first purchased them.

ALGO is buying and selling at $0.1818 at press time, with a 5% acquire over the previous 24 hours. At this market worth, solely 8% of Algorand holders are worthwhile. In parallel, 3% is on the break-even level, neither bearish revenue nor income.

Notably, among the many cryptocurrencies monitored by IntoTheBlock, ALGO stands out as having the best proportion of holders in a shedding place.

As well as, IntoTheBlock statistics confirmed that a minimum of 83% of those Algorand traders are long-term traders, holding property for greater than a 12 months. Solely 15% entered the ALGO market within the final 12 months. In the meantime, 2% of the spectrum of holders are those that purchased ALGO inside the final 30 days.

Silvio Micali, a professor on the Massachusetts Institute of Expertise (MIT), based Algorand in 2017. The blockchain challenge garnered reward from the now notorious US Securities and Change Fee (SEC) chairman Gary Gensler.

This was throughout Gensler's tenure educating on the MIT Sloan College of Administration in 2018 and 2019. Particularly, throughout the 2019 presentation, Gensler famous that Algorand is “nice know-how that has the facility you might create an Uber with.”

This affirmation gained significance after Gensler assumed the function of SEC chairman in 2021. Nonetheless, when the SEC filed a lawsuit towards crypto buying and selling platform Bittrex final April, it categorised ALGO as a safety.

Regardless of preliminary optimism and assist, Algorand has struggled to maintain up with its friends in recent times. Three months after Gensler's 2019 presentation, ALGO climbed to an all-time excessive of $3.56. Buying and selling at round $0.1818, the asset has mirrored a staggering 94% decline in worth since then.

Disclaimer: The data supplied on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any sort. Coin Version shall not be answerable for any losses incurred on account of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.