- Ripple CTO David Schwartz emphasizes understanding tax implications in AMM transactions.

- A tweet shared by a person exhibits an instance of as much as 24% excessive AMM returns when selecting XRP.

- David Schwartz takes cost of the Twitter dialog and sheds gentle on AMM’s tax challenges.

David Schwartz, co-founder of Ripple, emphasizes the significance of understanding the tax implications related to AMM transactions. The CTO additional defined that depositing and withdrawing belongings from these funds can set off taxable occasions, as customers successfully convert their cryptocurrency to Liquidity Supplier (LP) tokens upon deposit and again to cryptocurrency upon withdrawal.

The idea of “foundation” is essential for orientation within the tax atmosphere of AMM transactions. The worth of the belongings deposited into the AMM pool on the time of entry serves as the premise for the LP tokens and governs the calculation of capital good points or losses upon redemption or sale.

ČTÚ requested buyers to contemplate a hypothetical situation the place an investor places a mix of belongings into the AMM fund and subsequently redeems a part of their LP tokens. Realized good points or losses are depending on modifications in asset values and established foundation on the time of deposit.

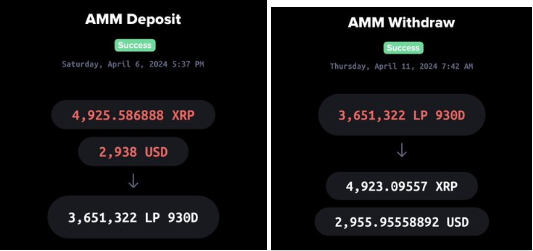

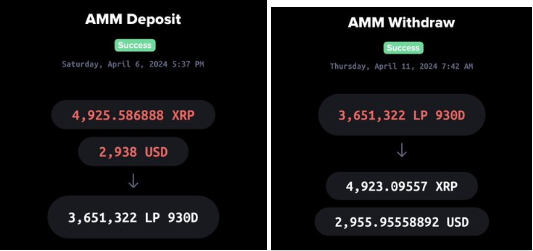

David Schwartz was responding to an ongoing twitter dialog praising the XRP AMM Yeild Within the tweet, Hartner particulars an AMM deposit he manufactured from 4926 XRP and $2938 USD. Then, 4.6 days later, he made a withdrawal and obtained 4923 XRP and 2956 USD. He calculates that in 4.6 days he had a mixed annualized return of 24%.

Customers like Niel Hartner shared their spectacular returns achievable by means of AMM funds, with some customers boasting annual good points in extra of 20%. These funds enable individuals to earn returns by storing their cryptocurrency holdings and profit from the liquidity offered to facilitate decentralized buying and selling.

Disclaimer: The data offered on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shall not be answerable for any losses incurred on account of using stated content material, services or products. Readers are suggested to train warning earlier than taking any motion associated to the Firm.