Analyzing the ebb and circulation of futures contracts throughout exchanges can present invaluable perception into the collective market outlook. Bitcoin futures open curiosity standing and the ratio between lengthy and brief positions may also help us decide whether or not the market is bullish or bearish and predict potential worth actions.

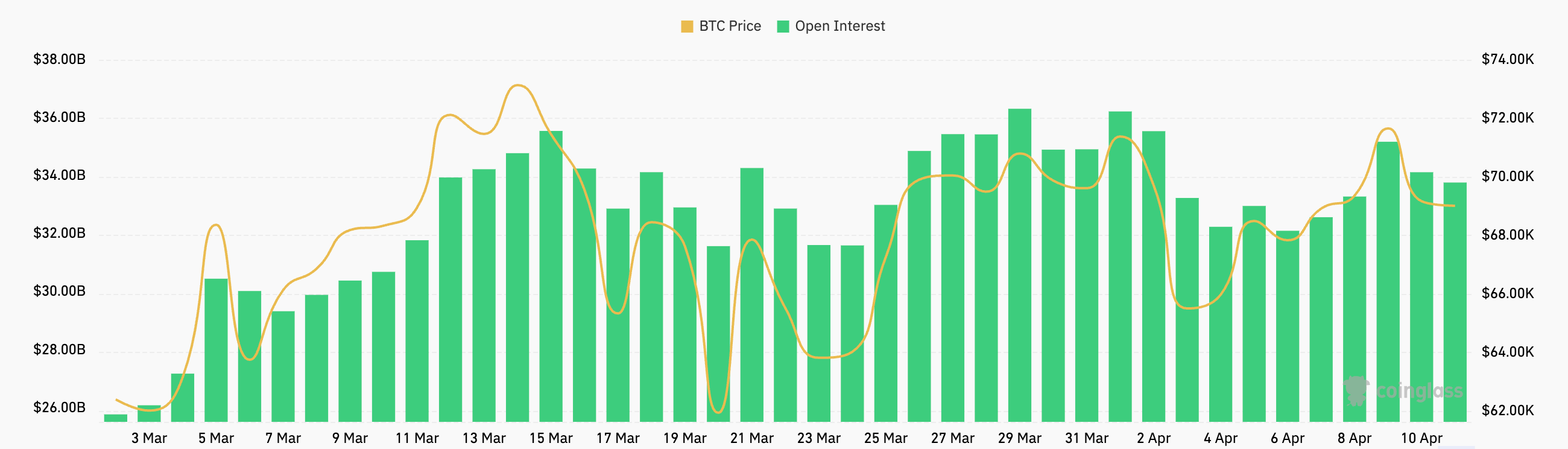

Within the 24 hours between April 9 and 10, the futures market noticed a slight however notable transfer. Open curiosity, a measure of the overall variety of excellent futures contracts that haven’t been settled, fell from $35.17 billion to $33.77 billion. This decline in open curiosity, together with a 4.55% decline in lengthy positions to $39.65 billion and a smaller 0.38% lower in brief quantity to $37.31 billion, suggests a cautious discount in market participation. These numbers point out a slight bearish bias in dealer sentiment over the previous 24 hours.

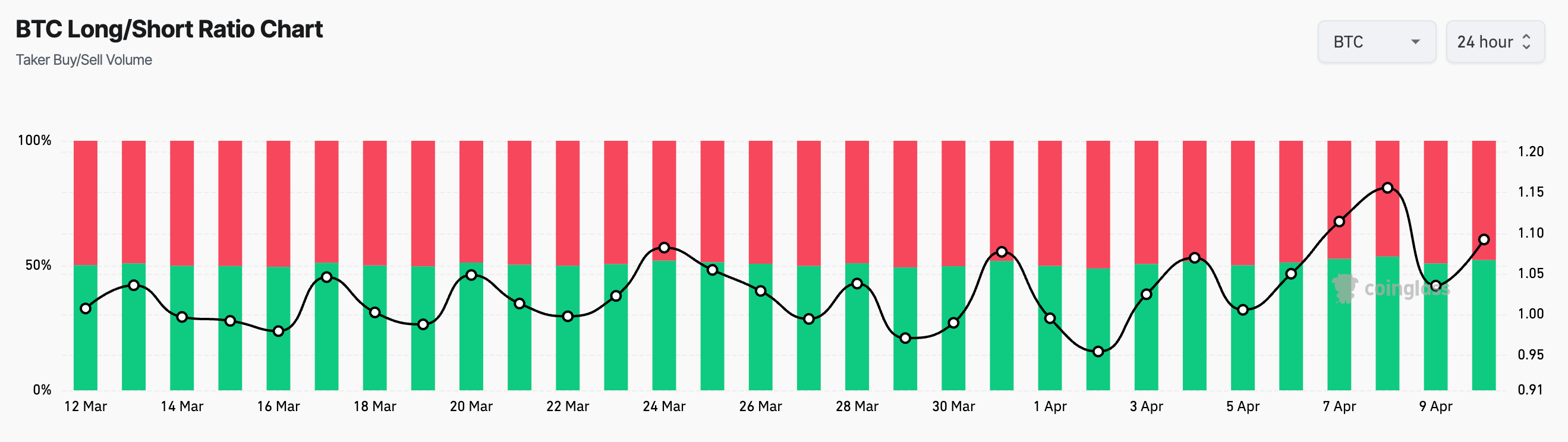

The volatility of the lengthy/brief futures ratio over the previous few weeks illustrates how the market has been feeling. Whereas the ratios have fluctuated, they’ve typically remained constructive, so it’s clear that the market is leaning in direction of a bullish stance. Nonetheless, confidence ranges have assorted in response to Bitcoin worth fluctuations. The height of 1.1561 on April eighth correlated with a pointy rise in Bitcoin’s worth following a correction, whereas the drop to 0.9712 on March twenty ninth mirrored a wave of bearish sentiment that got here after BTC failed to fulfill market expectations.

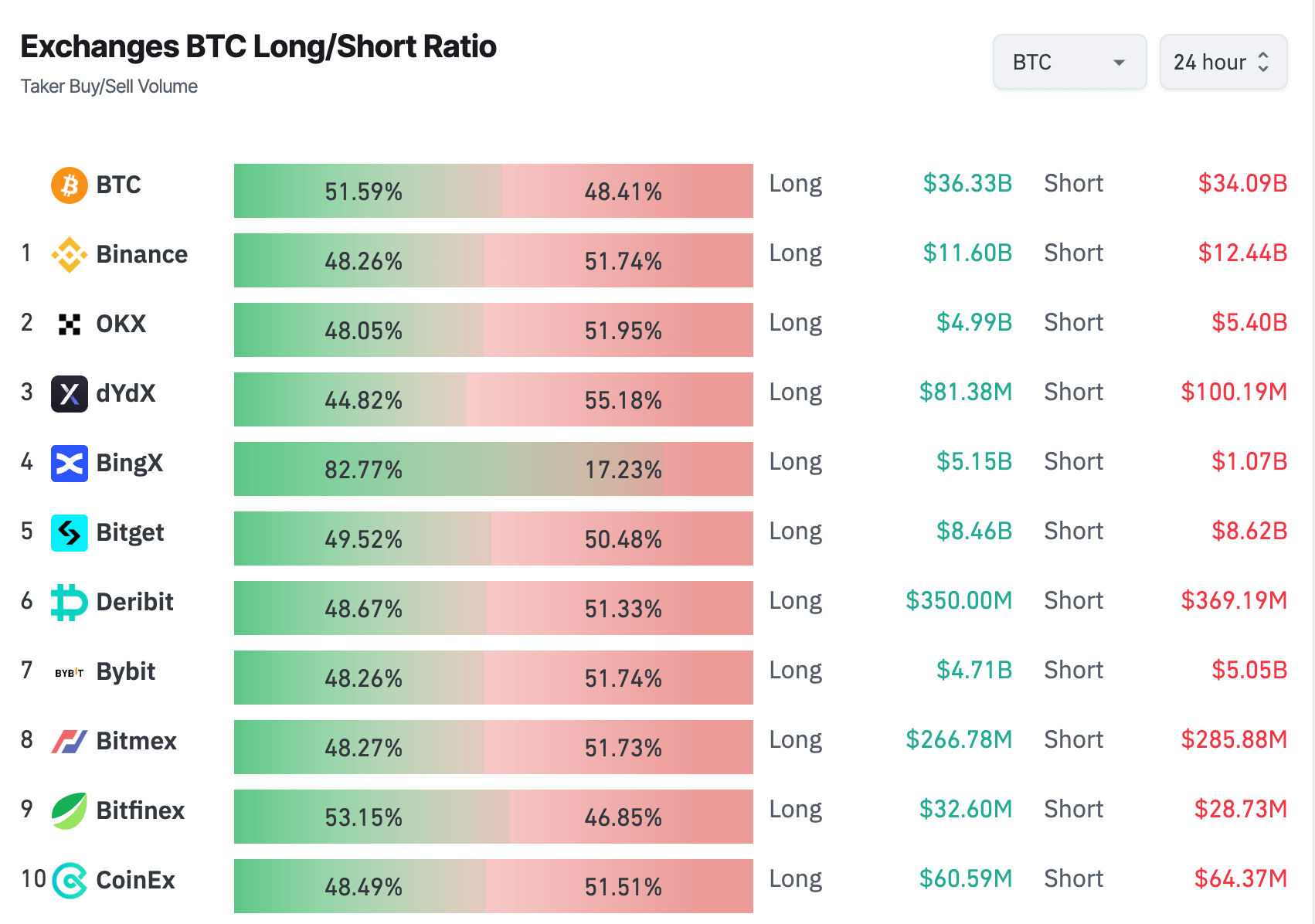

A more in-depth have a look at the distribution of lengthy and brief positions throughout completely different exchanges reveals a really various panorama of dealer sentiment and technique. For instance, BingX stands out with a considerably larger proportion of lengthy positions (82.77%) than brief positions (17.23%), indicating significantly bullish sentiment amongst its person base or the strategic place of merchants on the change.

However, platforms like Deribit and Bitget with ratios hovering round 50% point out a extra evenly break up market outlook. The distinction between Binance’s predominant brief bias (51.74%) and BingX’s bullish bias reveals how various methods and perceptions are throughout buying and selling platforms, with Binance’s brief positions considerably outnumbering BingX’s lengthy bets.

The slight decline in open curiosity that the market has seen over the previous 24 hours suggests a collective shift to warning. This might be attributable to many alternative elements, however the largest uncertainty out there as Bitcoin continues to battle to regain $70,000 will be the largest. The contraction in OI may additionally replicate a broader hesitancy amongst merchants to decide to lengthy positions.

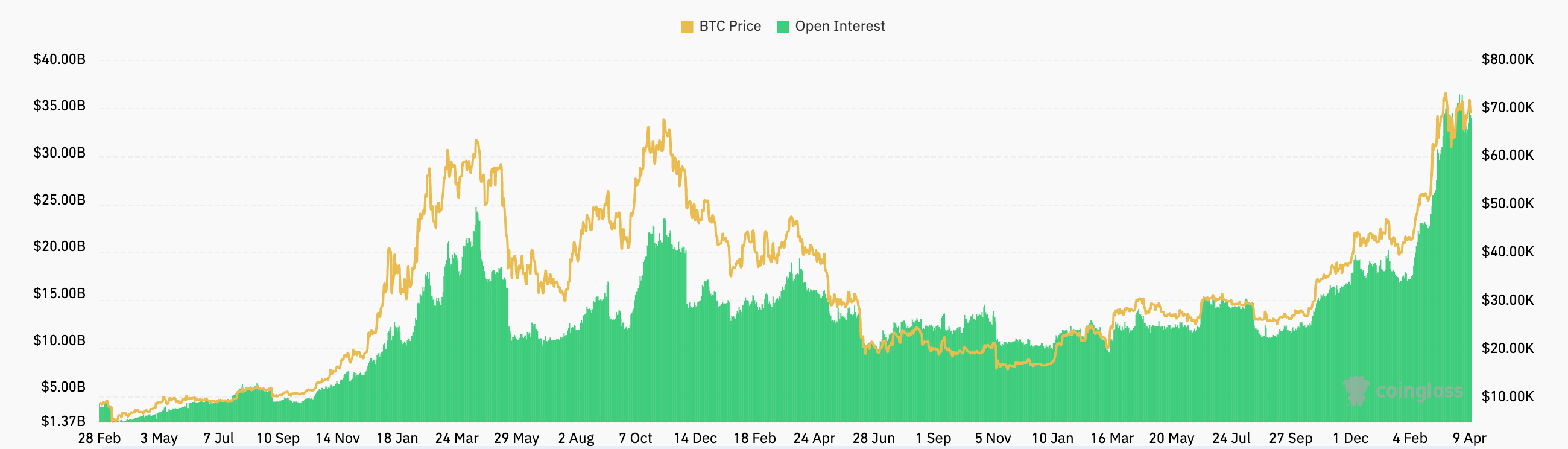

Nonetheless, you will need to observe that the combined sentiment and cautious stance throughout numerous exchanges is said to the latest OI excessive seen by the market. Regardless of the decline in latest days, the market remains to be in a derivatives cycle with the best open curiosity in Bitcoin historical past.

Which means that the warning and indecision we’re seeing now’s acute and doesn’t characterize the long-term pattern seen this yr. Elements similar to macroeconomic developments, regulatory modifications and inner developments within the crypto market similar to ETFs are more likely to affect this sentiment.

We are able to anticipate the present pattern to vary because the market continues to digest these parts. Future expectations and buying and selling methods rapidly adapt to new market developments, so you will need to maintain a detailed eye on derivatives.

The publish Bearish Tilt in Bitcoin Futures as Open Curiosity Contracts appeared first on fromcrypto.