Cryptocurrency-related funding merchandise continued their upward trajectory, seeing $646 million in inflows over the previous week, in response to CoinShares’ weekly report.

This inflow brings the full for the 12 months to an unprecedented $13.8 billion, bringing complete property underneath administration to a staggering $94.47 billion.

Bitcoin ETF hype moderation

Buying and selling quantity for crypto funding merchandise fell final week, shrinking to $17.4 billion from $43 billion recorded within the first week of March. This implies a doable softening of investor curiosity in bitcoin exchange-traded funds (ETFs) after weeks of consecutive hype.

In the meantime, bitcoin stays a focus for traders, sustaining its market dominance because the approval of the ETF in January. Over the previous week, BTC-related merchandise witnessed a major constructive web movement of $663 million.

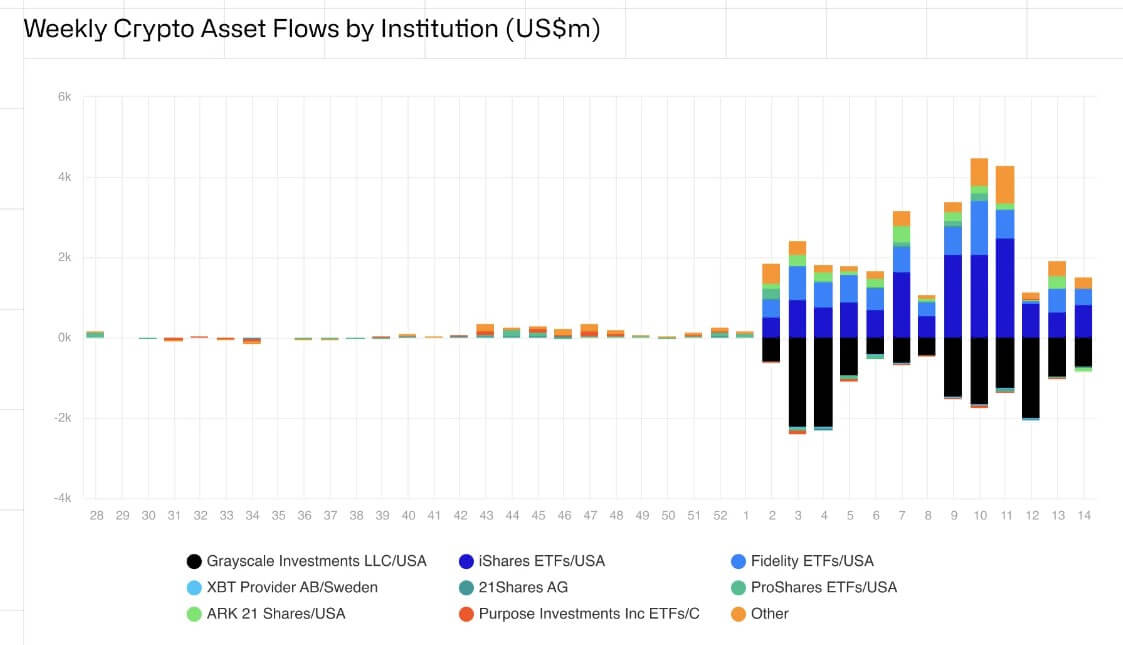

The lion’s share of that influx got here from BlackRock’s iShares, which amassed $811 million, with Constancy FBTC following at $395.83 million. In distinction, Grayscale GBTC noticed an outflow of $731 million.

Whereas bitcoin merchandise boomed, outflows from different digital property noticed complete web flows drop to $646 million. Ethereum witnessed its fourth straight week of outflows, shedding one other $22.5 million. In consequence, year-to-date ETH web flows fell to $52 million.

Quite the opposite, chosen altcoins have proven resilience. Solana, Litecoin, and Filecoin attracted notable inflows of $4 million, $4.4 million, and $1.4 million, respectively.

Moreover, the present bullish sentiment available in the market has resulted in brief bitcoin merchandise experiencing a 3rd consecutive week of outflows totaling $9.5 million. This displays waning conviction amongst bearish traders, particularly as the value of BTC jumped round 4% over the previous week to over $70,000 at press time.

Regardless of the “moderating” urge for food for Bitcoin ETFs, the USA maintained its place because the market chief with complete inflows of $648 million. Brazil, Germany and Hong Kong additionally noticed vital inflows of US$9.8 million, US$9.6 million and US$9 million respectively.

Conversely, Canada and Switzerland noticed outflows of $27 million and $7.3 million respectively, underscoring regional variations in market sentiment.

The submit Investor Enthusiasm for Bitcoin ETFs Cools Regardless of Crypto Funds Up $646M Weekly appeared first on fromcrypto.