Glassnode’s web hodler place change metric gives an in depth take a look at the conduct of long-term Bitcoin traders. This metric is calculated by monitoring the influx and outflow of wallets categorized as holders – or these which have been “hanging on” for very lengthy intervals of time.

This metric is essential to understanding market sentiment, significantly the boldness stage of traders identified for his or her long-term dedication to holding Bitcoin no matter market volatility.

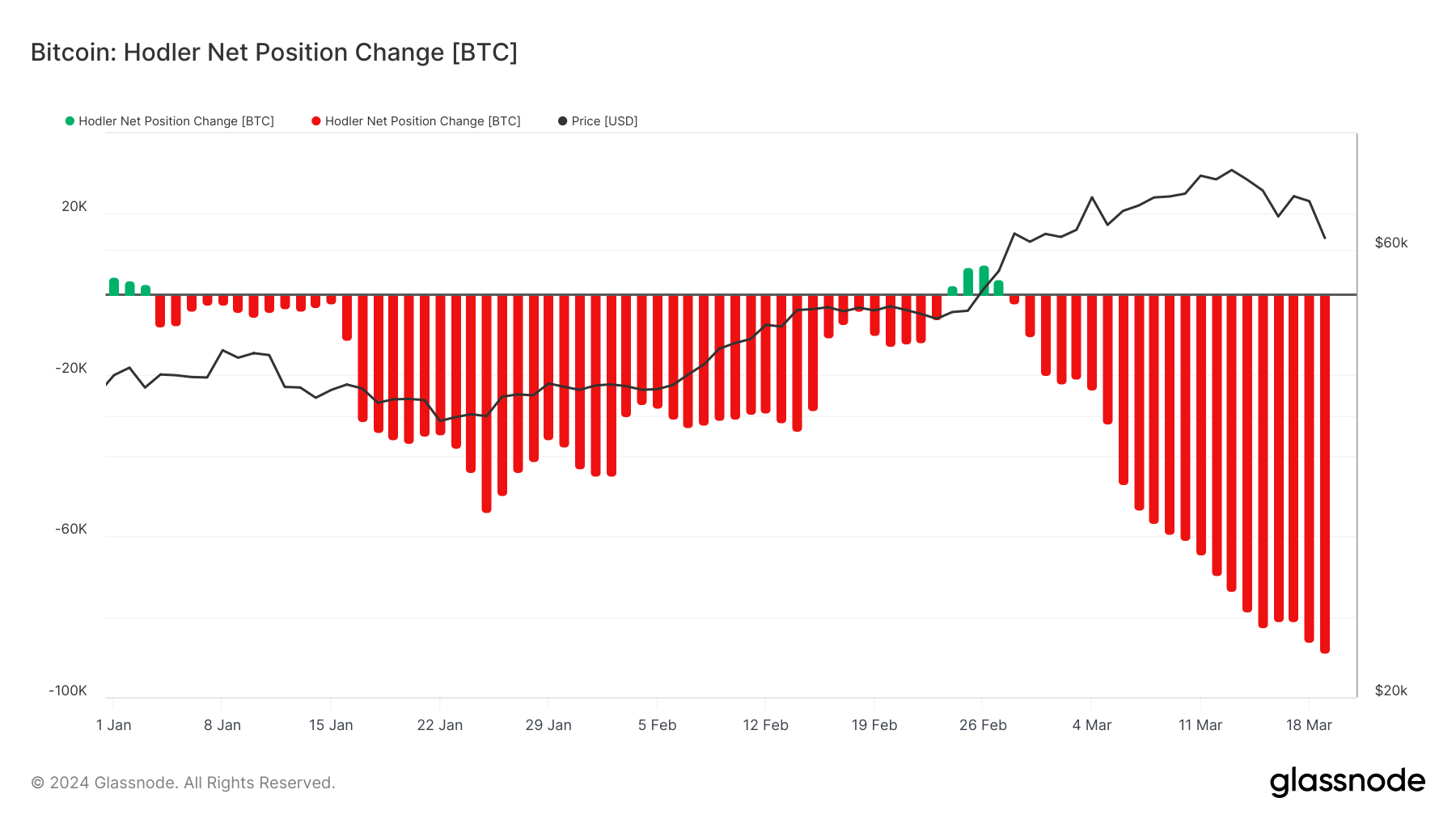

On March 19, the 30-day hodler web place change reached -88,860 BTC, marking probably the most vital unfavorable shift in three years.

This downtrend has continued since January 4th, interrupted solely by a quick four-day interval of optimistic change in late February. This vital discount in hodler balances comes after a pointy correction within the value of Bitcoin – which fell from a peak of $73,000 on March thirteenth to simply beneath $61,000 by March twentieth.

Such a major unfavorable change in hodler worth normally alerts a change in long-term investor conduct and should point out lowered confidence in bitcoin’s value stability within the close to future. The timing and magnitude of those adjustments might point out a major shift in sentiment amongst these traders, who’re usually identified for his or her resilience throughout market volatility.

Nonetheless, deciphering the state of the market by means of a single metric reminiscent of hodler web place change may be deceptive if different indicators aren’t taken into consideration.

Earlier fromcrypto evaluation discovered that regardless of short-term value volatility and elevated promoting stress on centralized exchanges, the underlying pattern of accumulation available in the market remained intact.

This may be seen within the distinction between the market cap and the realized cap, indicating that the lower in market worth didn’t deter the buildup of bitcoins, with the realized cap displaying a rise within the realized worth of all cash moved on the community.

Regardless of the decline in long-term holder balances since December 2023, this continued accumulation means that different elements are at play. Potential contributors to this pattern are a decline in over-the-counter (OTC) balances and vital outflows from Grayscale’s ETFs.

Serving high-volume merchants and establishments, OTC counters facilitate giant transactions with minimal market affect. A lower in OTC balances might point out that institutional traders are shifting their holdings to exchanges, presumably in anticipation of gross sales or to fulfill liquidity wants. This contributes to a unfavorable change in Hodler’s web place with out essentially implying a broad sell-off amongst particular person long-term holders.

As well as, outflows from Grayscale’s GBTC, a key institutional bitcoin publicity car previous to the launch of spot bitcoin ETFs, might have considerably impacted hodler’s web place. These strikes might be pushed by traders reallocating to ETFs with extra aggressive charges or liquidating positions as a result of market situations.

The info exhibits the significance of contemplating a number of sources and on-chain metrics to achieve a complete understanding of the market. Institutional actions can have an outsized affect on market indicators and should not at all times match the sentiment and conduct of the broader investor group.

The submit What’s Pushing Bitcoin’s Hodler Balances Down? appeared first on fromcrypto.