The crypto scene continues to be so scorching that Bitcoin is hitting one new excessive after one other. It topped $72,700 on Monday. This was initially because of the approval of spot bitcoin ETFs, however is now being pushed greater forward of the “halving” occasion, which can restrict the quantity of recent provide put into circulation from bitcoin miners.

Bitcoin is up 9.5% over the previous seven days and up 50% month-to-date, in keeping with information from CoinMarketCap. The overall cryptocurrency market cap throughout all tokens elevated by 10% for the week to $2.71 trillion, with bitcoin accounting for 52.7% of that quantity.

There may be, in fact, no solution to inform how excessive Bitcoin could rise through the present bull frenzy. Whereas many are feeling the hopium, there may be at the least one indicator that thinks we’re nearing the highest of the excessive, with worth drops shortly following.

The CoinMarketCap Crypto Concern & Greed Index is within the “Excessive Greed” zone at 89.12 factors in early February, up from “Impartial” at 59.3 factors. The index measures the costs and buying and selling information of the biggest cryptocurrencies, and its consumer habits information measures crypto market sentiment from 0 to 100. When the index is near zero, buyers have oversold their positions “irrationally”, in comparison with when the worth is nearer to 100, there would be the market is more likely to face a correction.

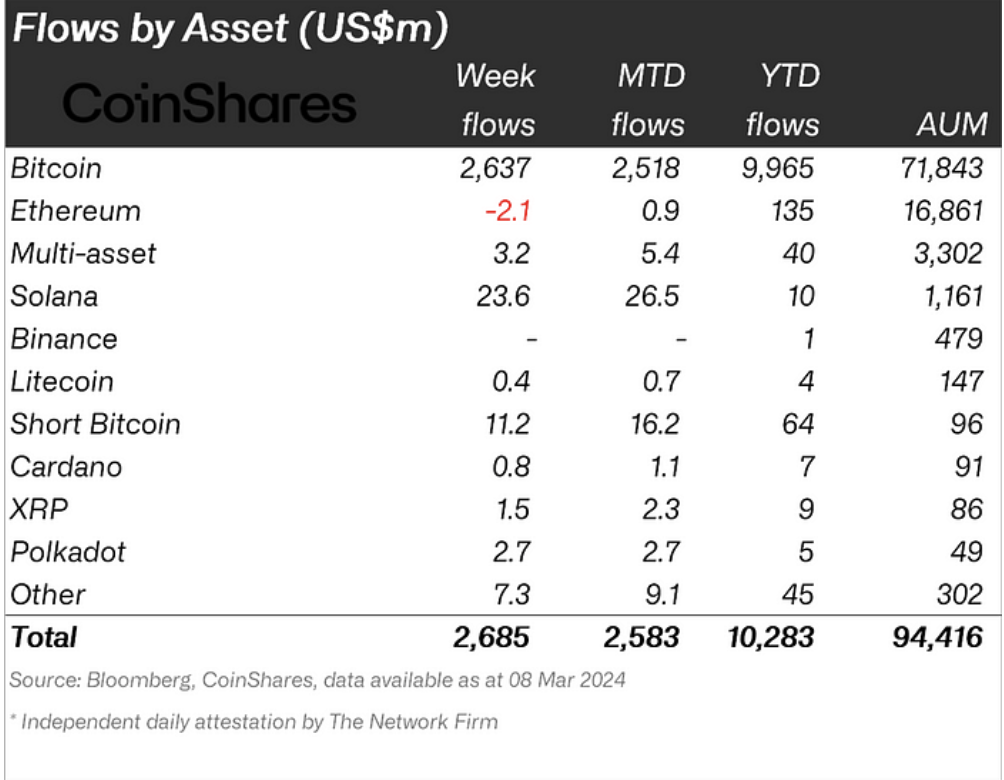

That stated, bitcoin remained a high goal for retail and institutional buyers, with inflows of $2.6 billion for the week, or cash put into the asset, and $9.9 billion year-to-date, in keeping with CoinShares’ Digital Asset Fund Flows Weekly . Message. Ether, the second largest cryptocurrency, is just not instantly benefiting from any of the hype with Bitcoin enthusiasm. Its inflows had been down $2.1 million final week, although it is up $135 million for the reason that begin of the 12 months.

CoinShares Quantity 173: Weekly Digital Asset Fund Stream Report. Thanks for the photographs: CoinShares

Regardless of how excessive buyers push bitcoin up forward of the bitcoin halving occasion, which is predicted in mid-April and can happen each 4 years, there isn’t any motive to imagine that what goes up is not going to be diminished. Once more. In earlier cycles, Bitcoin halvings boosted demand and costs for the cryptocurrency.

Bitcoin’s final halving was on Could 11, 2020, and by April 2021, it had elevated its worth by about 600% from round $9,000 to $63,000. It then fell by about 50% over three months, signaling renewed volatility within the asset.