The runes had been launched on April 20, the day of the fourth Bitcoin halving. Fueled by the hype surrounding the much-anticipated halving, they launched with a bang and garnered an unbelievable quantity of consideration and exercise.

Their launch triggered fairly a stir within the crypto business, particularly within the Bitcoin market, the place it sparked a livid debate in regards to the future and utility of Bitcoin, not in contrast to what we noticed when Bitcoin exhibits had been launched.

It's now been a month because the Runes launched – lengthy sufficient to provide us a stable concept of how they've affected the market and permit us to make some predictions about their future.

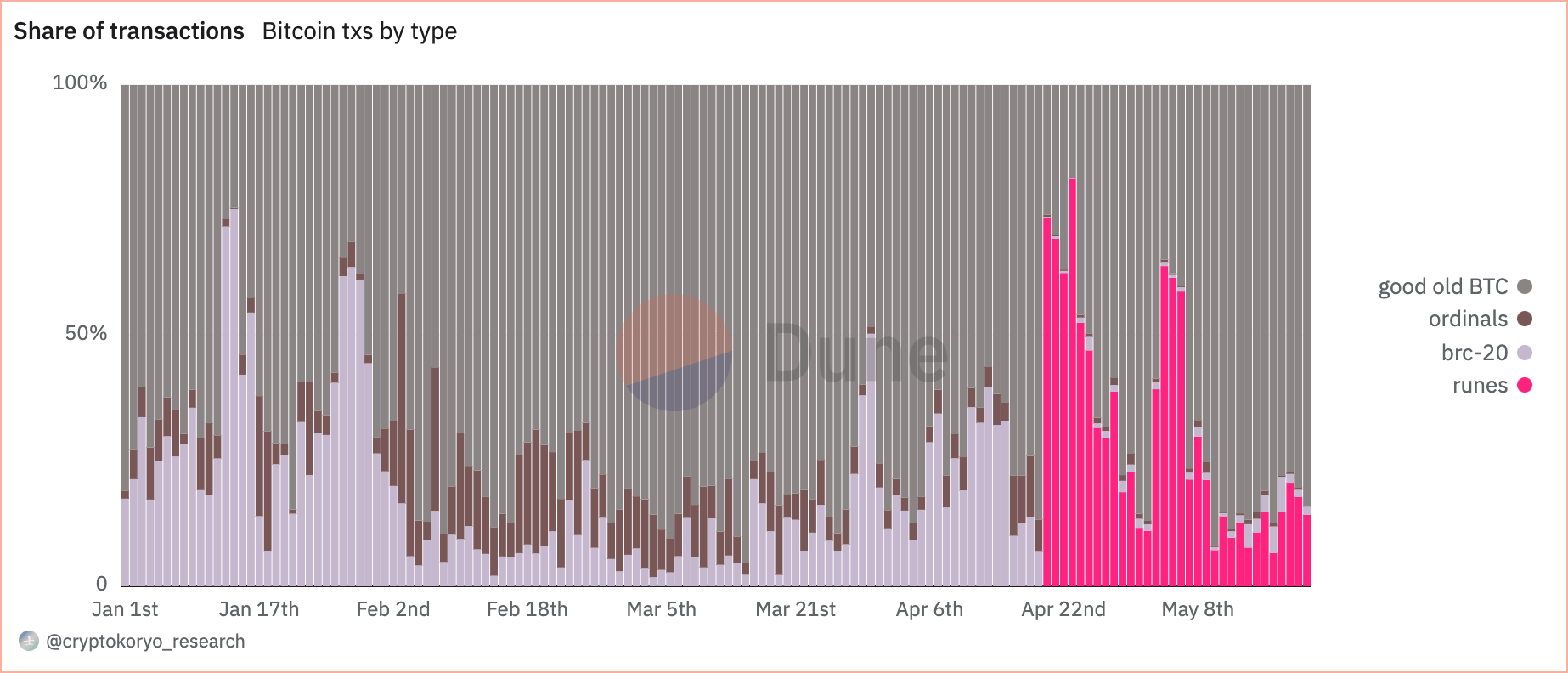

fromcrypto's preliminary evaluation confirmed that the preliminary influence of Runes in the marketplace was substantial. On the day of the halving, Runa transactions accounted for 57.7% of all Bitcoin transactions that day, in comparison with simply 0.5% for Ordinals and 0.2% for BRC-20 tokens.

Whereas this sudden dominance mirrored the huge curiosity in Runes, it was clear that such a pointy improve in transaction share was unsustainable in the long run.

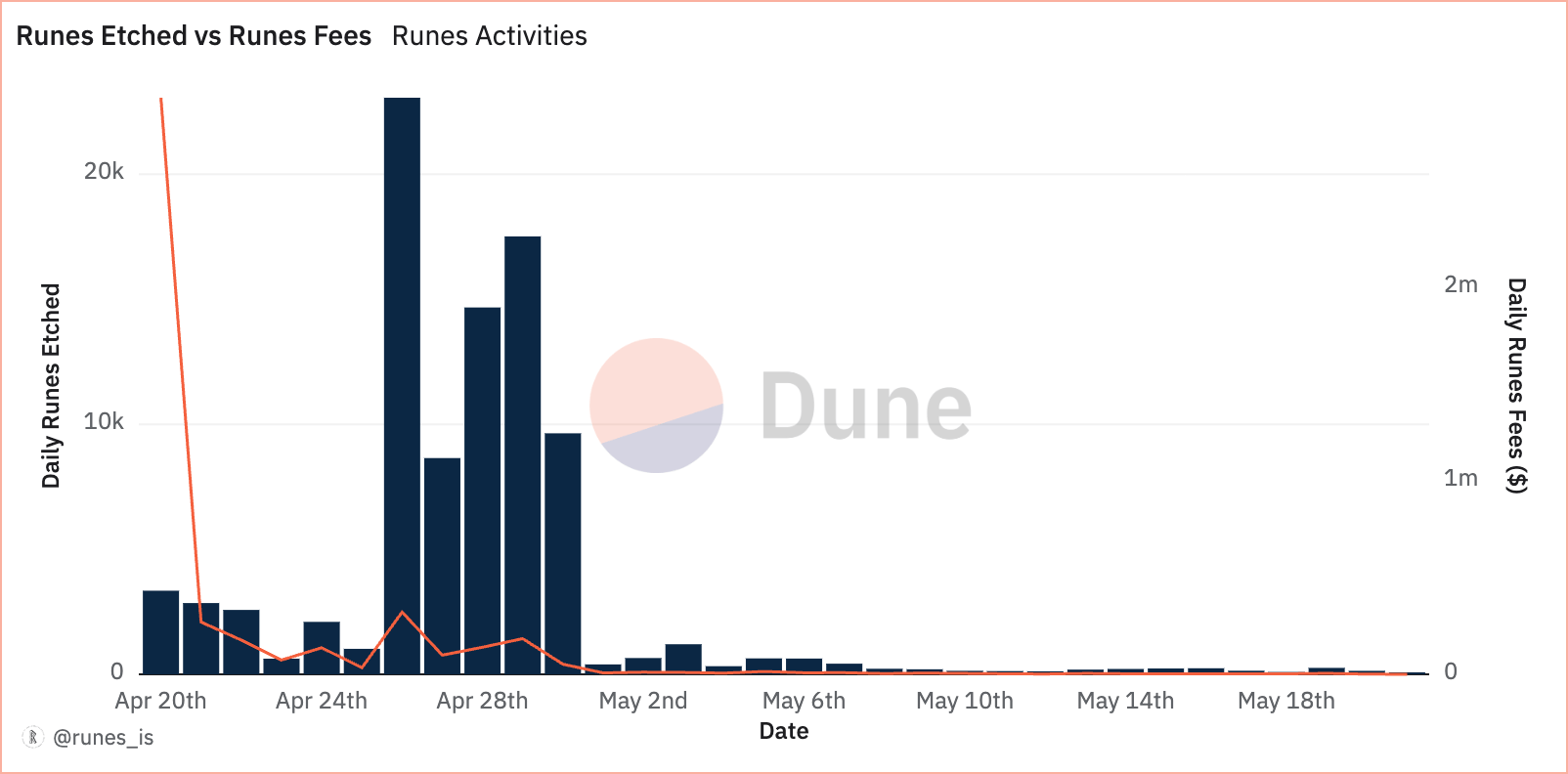

Every day knowledge from Dune Analytics confirmed a fluctuating sample of Run exercise within the days following launch. On April 20, 3,344 runs had been etched, bringing in $2.997 million in charges. This excessive stage of exercise was short-lived and a pointy decline was noticed within the following days.

By April 23, solely 625 runes had been etched, with charges falling to $73,793. The height occurred on 26 April with 23,061 runs etched, however this momentum was not sustained and the numbers fell to 139 runs by 20 Might.

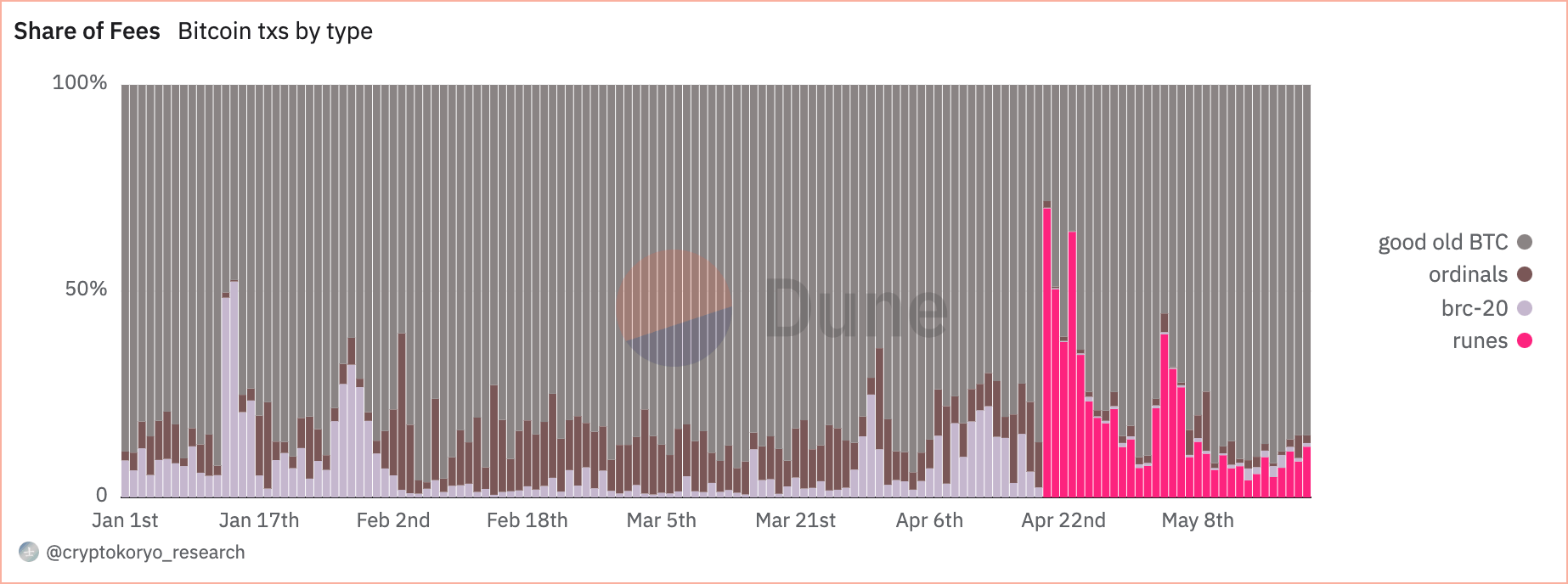

Runes' share of complete bitcoin charges was additionally unsustainable. On April 20, they made up 70.1% of charges. These numbers fluctuated considerably all through the month, with transaction shares reaching 81.3% and costs 64.4% on April twenty third. By Might 20, Runa transactions accounted for 17.8% of the overall, and costs fell to eight.7%.

Regardless of the drastic drop in reputation and utilization, Runes nonetheless managed to depart fairly a mark on the Bitcoin market. Within the first 30 days, a complete of 92,713 runes had been created by 7.150 million transactions, with mint transactions accounting for 3.861 million of them.

All of those actions generated a big quantity of transaction charges totaling 2,299 BTC, with 1,282 BTC derived from coin transactions alone.

The information means that runes are settling right into a extra secure, if much less dominant, function throughout the Bitcoin ecosystem. This sample mirrors that of Ordinals, who confronted related preliminary enthusiasm adopted by stabilization.

As runes develop into a extra everlasting fixture within the Bitcoin market, their influence on charges and transactions is anticipated to lower considerably. Even only a month after their launch, the preliminary spike in exercise and costs has subsided, resulting in a extra secure and predictable integration into the Bitcoin transaction panorama. Whereas we will anticipate a short-term spike in exercise throughout in style mints, this stability is more likely to proceed within the coming months.

The submit 30 days of Runes: Curiosity fizzes after spectacular launch appeared first on fromcrypto.